- Joined

- 16 May 2011

- Messages

- 21,065

- Reaction score

- 30,271

Experts say Direct-To-Home players, cable operators in dire need of additional investments

Private Equity firms which are reluctant for investments due to regulatory hurdles, have seen a huge opportunity in the ongoing digitisation drive of Indian government.

According to experts, Direct-To-Home (DTH) players and cable operators, in dire need of additional investments, are likely to tap the PE investors in India as a main source.

According to a recent Ficci KPMG report, the number of Cable and satellite (C&S) households in India increased by 11 million in 2012, to reach 130 million and the paid C&S base is expected to grow to 173 million by 2017, representing 91 percent of TV households.

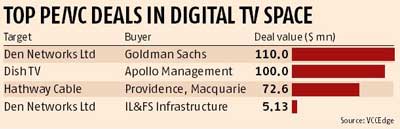

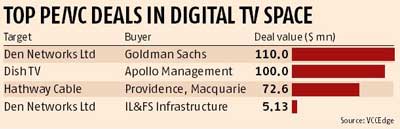

This week, DEN Networks Ltd, a leading Indian cable distribution company, has raised a total of $180 million (Rs 1,000 crore) through mix of preferential allotment and qualified institutional placement (QIP). Through preferential placement, the company raised $110 million (Rs 600 crore) from PE arm of Goldman Sachs.

Jagat Dave, Managing Director, Ambit Corporate Finance said, "The on-going digitisation roll-out entails significant capex for both DTH and cable operators. Digitisation will result in an addressable environment and therefore, over a period of time, transparent and fair revenue-share, significantly better ARPUs (Average revenue per user) and a more robust business model for the industry. Sensing this underlying theme, PE funds have shown keen interest to transact in this space and more such transactions will get announced."

Bharti Airtel's direct-to-home business (DTH) Airtel Digital TV is engaged in talks with PE majors - KKR, Carlyle and Bain Capital to sell off about 20% stake in its DTH business to raise about $200 million. PE funds are keen to invest in DTH space after India decided to increase the foreign direct investment limit in DTH and digital cable companies from 49% to 74%.

Last year, PE firm Providence Equity had bought 9.9% in Hathway Cable for Rs 205 crore, while Macquarie had picked 7.4% stake for Rs 153 crore. US private equity firm Apollo Global Management LLC had bought 11% stake in India's largest direct-to-home service operator Dish TV for about $100 million in 2009.

Other DTH players who are in fundraising mode include Videocon which has filed DRHP to raise about Rs 700 crore for its DTH arm Bharat Business Channel, and Tata Sky which plans a Rs 2500-crore IPO.

Aneesh Vijayakar, Partner, KPMG India said, "Digitization, is not only seeding of boxes but also eventual increase in ARPU’s and differentiated content. DTH currently has approximately 30% of the paid Cable and satellite (C&S) subscriber base. DTH is expected to continue to add on new C&S subscribers especially as mandatory digitization spreads into Tier II and III cities."

As part of digitisation, the multi-system operators (MSOs) — Hathway Cable and Datacom, Den Networks, IndusInd Media and Communications Ltd (IMCL), Citicable and Digicable — are expected to cough up Rs 2,500-3,000 crore for set-top-boxes (STBs).

"Accordingly, amongst other things, PE investors need to take is if DTH will be able to add on more or equal subscribers than digital cable over the next 4-5 years," Vijayakar added.

According to Ficci-KPMG report, the television industry in India is estimated at Rs 370 billion in 2012, and is expected to grow at a CAGR of 18% over 2012-17, to reach Rs 848 billion in 2017. “Aided by digitisation and the consequent increase in ARPUs, the share of subscription revenue to the total industry revenue is expected to increase from 66 percent in 2012 to 72 percent in 2017,” it said.

Cable digitisation opens the door to more PE deals | Business Standard

Private Equity firms which are reluctant for investments due to regulatory hurdles, have seen a huge opportunity in the ongoing digitisation drive of Indian government.

According to experts, Direct-To-Home (DTH) players and cable operators, in dire need of additional investments, are likely to tap the PE investors in India as a main source.

According to a recent Ficci KPMG report, the number of Cable and satellite (C&S) households in India increased by 11 million in 2012, to reach 130 million and the paid C&S base is expected to grow to 173 million by 2017, representing 91 percent of TV households.

This week, DEN Networks Ltd, a leading Indian cable distribution company, has raised a total of $180 million (Rs 1,000 crore) through mix of preferential allotment and qualified institutional placement (QIP). Through preferential placement, the company raised $110 million (Rs 600 crore) from PE arm of Goldman Sachs.

Jagat Dave, Managing Director, Ambit Corporate Finance said, "The on-going digitisation roll-out entails significant capex for both DTH and cable operators. Digitisation will result in an addressable environment and therefore, over a period of time, transparent and fair revenue-share, significantly better ARPUs (Average revenue per user) and a more robust business model for the industry. Sensing this underlying theme, PE funds have shown keen interest to transact in this space and more such transactions will get announced."

Bharti Airtel's direct-to-home business (DTH) Airtel Digital TV is engaged in talks with PE majors - KKR, Carlyle and Bain Capital to sell off about 20% stake in its DTH business to raise about $200 million. PE funds are keen to invest in DTH space after India decided to increase the foreign direct investment limit in DTH and digital cable companies from 49% to 74%.

Last year, PE firm Providence Equity had bought 9.9% in Hathway Cable for Rs 205 crore, while Macquarie had picked 7.4% stake for Rs 153 crore. US private equity firm Apollo Global Management LLC had bought 11% stake in India's largest direct-to-home service operator Dish TV for about $100 million in 2009.

Other DTH players who are in fundraising mode include Videocon which has filed DRHP to raise about Rs 700 crore for its DTH arm Bharat Business Channel, and Tata Sky which plans a Rs 2500-crore IPO.

Aneesh Vijayakar, Partner, KPMG India said, "Digitization, is not only seeding of boxes but also eventual increase in ARPU’s and differentiated content. DTH currently has approximately 30% of the paid Cable and satellite (C&S) subscriber base. DTH is expected to continue to add on new C&S subscribers especially as mandatory digitization spreads into Tier II and III cities."

As part of digitisation, the multi-system operators (MSOs) — Hathway Cable and Datacom, Den Networks, IndusInd Media and Communications Ltd (IMCL), Citicable and Digicable — are expected to cough up Rs 2,500-3,000 crore for set-top-boxes (STBs).

"Accordingly, amongst other things, PE investors need to take is if DTH will be able to add on more or equal subscribers than digital cable over the next 4-5 years," Vijayakar added.

According to Ficci-KPMG report, the television industry in India is estimated at Rs 370 billion in 2012, and is expected to grow at a CAGR of 18% over 2012-17, to reach Rs 848 billion in 2017. “Aided by digitisation and the consequent increase in ARPUs, the share of subscription revenue to the total industry revenue is expected to increase from 66 percent in 2012 to 72 percent in 2017,” it said.

Cable digitisation opens the door to more PE deals | Business Standard