rahul1117kumar

Contributor

- Joined

- 21 Jun 2013

- Messages

- 6,758

- Reaction score

- 14,800

We at www.indiantelevision.com had noted and said thatContrary to expectations that the sunset date of 31 December 31, 2015 (Q3-16 in financial terms in India) would rake in good numbers for the DTH industry for Q4-16 the subscriber base growth just did not happen.At that time, results declared by three of India’s seven DTH players whose results are available un public domain did notshow much of a change.Further, at that time, though Airtel Digital TV and Videocon d2h had both shown a small spike in subscriber additions between Q2-2016 and Q3-2016, overall taking the combined addition in subscription numbers by all the three, the change was just 3.59per cent. In the case of the third player-Dish TV, it witnessed the lowest growth over a five quarter period starting Q3-2015 until Q3-16 at 2.19 per cent.

Results for Q4-16 (quarter ended 31 March 2016) showed a reversal of sorts in that trend. Dish TV announced that it had added 5 lakh subscribers – the highest additions in fiscal 2016. Airtel DTH and Videocon d2h added 6.19 lakh and 5.9 lakh subscribers respectively and each reported approximately 11 percent quarter-over-quarter (q-o-q) growth in operating profits in that quarter.It may be noted that TRAI (Telecom Regulatory Authority Regulatorreports for Q3-16 (quarter ended 31 December 2015) of the net active subscriber base included temporarily suspended subscribers that have been inactive for not more than 120 days – hence reflecting a huge 36 percent growth in active subscribers for that quarter.

Besides Airtel DTH, Dish TV and Videocon d2h, there are three other private DTH players in India – Reliance, Sun Direct and Tata Sky, and the government’s FreeDish. Airtel DTH, Dish TV and Videocon d2h (the three players in this report) represent about 65 percent of the private DTH active subscriber universe in India.

FreeDish DTH service – the largest DTH player by far in terms of subscribers with an estimated 15 million or 1.5 crore subscribers in 2015 as per the KPMG-FICCI Indian Media and Entertainment Industry Report 2016 (KPMG-FICCI M&E Report 2016) titled The Future: Now streaming. It must however be noted that an exact number for registered or active subscribers is not available since this is a free DTH service. The proposed merger of Videocon d2h with Dish TV will create the largest private television carriage player in India and the second largest in the world, be it cable, internet television or DTH or any other.

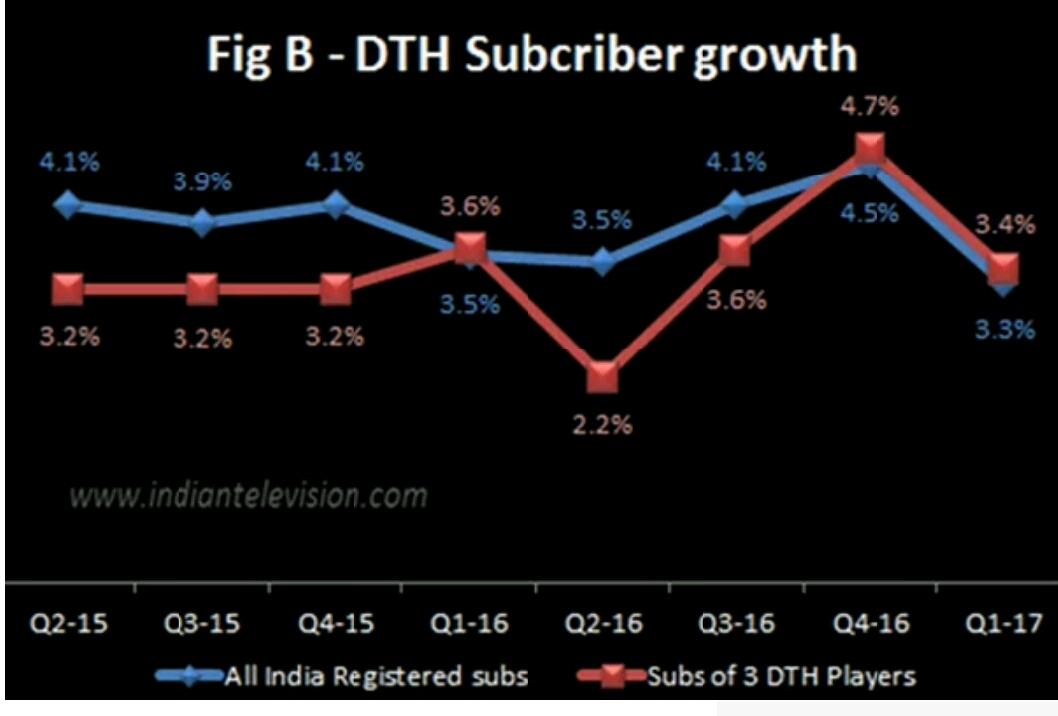

As per numbers released by TRAI for Q4-16 and the quarter ended 30 June 2016 (Q1-17), the growth of registered and active DTH subscribers has reduced from 4.5 percent and 4.6 percent in Q4-16 to 3.3 percent and 3.4 percent respectively in Q1-17. Overall, DTH active subscribers grew by 19.7 lakh or 8.06 percent q-o-q in Q1-17 to 605 lakh active subscribers (66 percent of registered subscribers) from 585.3 lakh (also 66 percent of registered subscribers) in Q4-16. The three players in this report contributed a combined 12.95 lakh or 65.74 percent in subscriber growth. Registered subscriber numbers were 915.3 lakh and 886.4 lakh in Q1-17 and Q4-16 respectively. In Q3-16, registered subscribers were 848 lakh.

In Q1-17, 4.65 lakh (3.97 percent growth), 4 lakh (2.76 percent growth) and 4.3 lakh (3.6 percent growth) were added q-o-q by Airtel DTH, Dish TV and Videocon d2h respectively.

Among the three, Airtel DTH added more net subscribers in absolute numbers in FY-16 than in FY-15, Dish TV added approximately the same number of net subscribers in both FY-15 and FY-16, while Videocon d2h saw slightly lower absolute net subscribers increment in FY-16 as compared to FY-15. Airtel DTH added 55.6 percent more subscribers in FY-16 – 16.52 lakh to reach net subscriber base of 117.52 lakh as compared to 10.62 lakh in FY-15; Dish TV added 15 lakh subscribers in FY-16 as well as in the previous year; Dish TV’s subscriber base was 145 lakh in FY-16; Videocon d2h added 16.8 lakh subscribers in FY-16 to reach a subscriber base of 118.6 lakh as compared to 17.4 lakh subscriber additions in FY-15. The above numbers are based on the financial results/investor presentations reported by the three DTH entities.

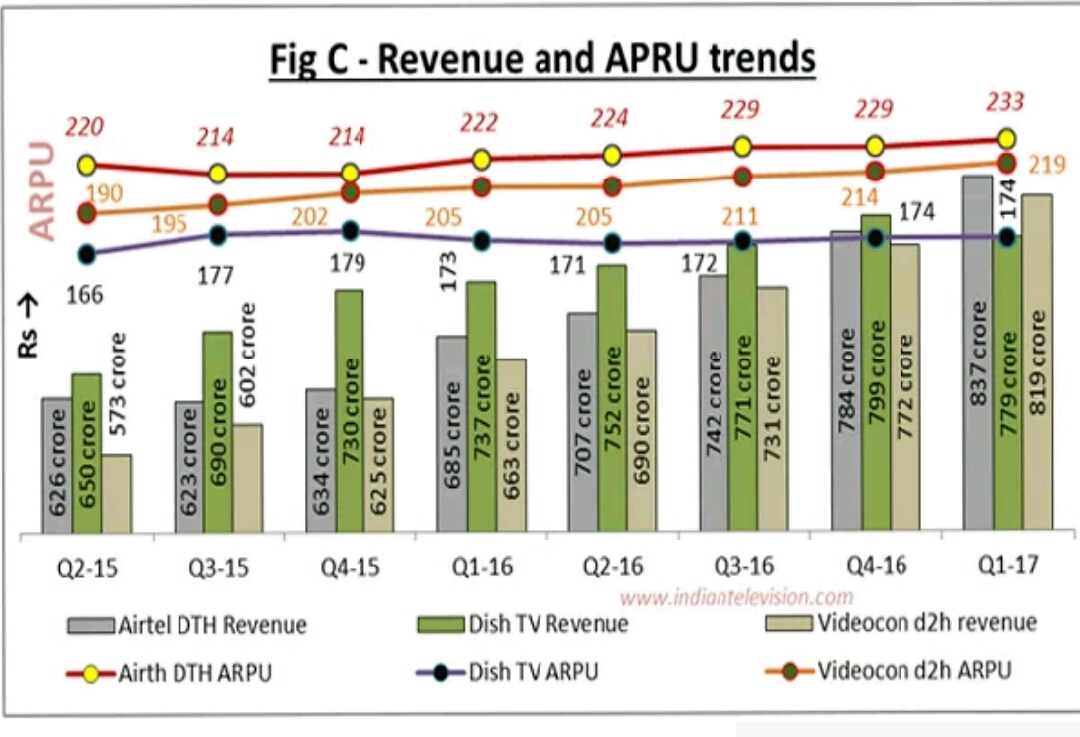

ARPU has been steadily increasing in the case of Airtel DTH and Videocon d2h, while it has was constant in the case of Dish TV at Rs 174 in Q4-16 as well as Q1-17. In Q2-17, however, Dish TV’s ARPU has dipped q-o-q by a huge Rs 12 to Rs 162.

For the first time in Q1-17, despite having the largest subscriber base amongst the top three, Dish TV’s revenues have been the lowest. In Q2-17, Airtel DTH reported the highest revenue amongst the three followed by Dish TV, with Videocon d2h’s revenue lower by just a few crore rupees. This could be mainly because Dish TV is more of a value player, whilst the other two are premium players. It may be noted Videocon d2h’s ARPU in Q2-17 has also dipped q-o-q by Rs 10 to Rs 209. Please refer to Fig C below for revenue and ARPU trends (Revenue numbers have been rounded off to the nearest Rs crore, ARPU numbers are in Indian Rupees, Rs)

Let us see how the three have performed in Q1-17

Airtel DTH

Revenue from Airtel’s DTH segment in Q1-17 increased 22.2 per cent to Rs 836.9 crore as compared to Rs 684.8 crore in the corresponding quarter of the previous year. Airtel’s DTH segment reported EBIT (Earnings before interest and tax) of Rs 121.9 crore (14.6 per cent operating margin) in Q1-17 as compared to EBIT of Rs 41.5 crore (6.1 percent operating margin) in Q1-16.

Airtel DTH added 4.24 lakh net subscribers in Q1-17 to bring its subscriber base to 121.9 lakh from 117.25 lakh in the previous quarter. Average revenue per user (ARPU) increased to Rs 233 from Rs 229 in the immediate trailing quarter. Airtel DTH reported a monthly subscriber churn of 0.8 percent in Q1-17, same as the churn in Q1-16 and Q4-16.

Dish TV

Dish TV reported 6.7 percent higher y-o-y subscription revenue of Rs 728.2 crore for Q1-17, as compared to Rs 682.8 crore. Operating revenue in Q1-17 increased 5.7 percent y-o-y to Rs 778.6 crore from Rs 736.7 crore in the corresponding quarter of the previous year.

Dish TV says that:

(1.1) For Q1-17, subscription revenue, on a like-to-like basis, was Rs 766.9 crore, a growth of 12.3 percent y-o-y.

(1.2) For Q1-17 operating revenue, on a like-to-like basis, was Rs 817.2 crore, a growth of 10.9 percent y-o-y.

Dish TV reported PAT of Rs. 40.9 crore in Q1-17, down 24.5 percent as compared to Rs 54.2 crore in Q1-16.

EBIDTA in the Q1-17 increased 12.2 percent to Rs 264.6 crore from Rs 235.7 crore in Q1-16.

The company reported addition of 4.02 lakh net subscribers for Q1-17. It closed the quarter with 149 lakh subscribers. Average revenue per user (ARPU) for Q1-17 remained the same year-over-year (y-o-y) and quarter-over-quarter (q-o-q) at Rs 174.

Videocon d2h

Videocon d2h is the second listed Indian DTH player to report a profit after tax (PAT), after the Essel group’s Dish TV that turned the numbers black last year. Videocon d2h reported PAT of Rs 2.7 crore for Q1-17. For the corresponding year ago quarter (Q1-17), the company had reported a loss of Rs 24.4 crore and for the immediate trailing quarter (Q4-16) reported loss was Rs 21.2 crore.

Videocon d2h subscription and activation revenue in Q1-17 increased 23.9 percent y-o-y to Rs 752.3 crore from Rs 607.3 crore and increased 6.6 percent q-o-q from Rs 705.6 crore.

The DTH major also reported 15.5 percent year-over-year (y-o-y) growth in net subscriber number growth at 122.9 lakh for Q1-17 as compared to 106.4 lakh and a 3.6 percent quarter-over-quarter (q-o-q) growth from118.6 lakh. Average revenue per user (ARPU) in Q1-17 increased to Rs 219 from Rs 205 in Q1-16 and from Rs 214 in the immediate trailing quarter.

Subscriber monthly churn in the current quarter was 0.49 percent; in Q1-16 it was slightly lower at 0.46 percent, while in the immediate trailing quarter it was much higher at 0.58 percent.

Comments

There is not much of a change in the comments and conclusions drawn by us for FY-16 numbers. Overall, the pay DTH industry is turning profitable as is obvious from the results.

DAS III and IV were/are sunshine periods for the television carriage industry. Activation revenues have been adding to the top lines and bottom lines of most of the players. Have they been able to optimise the opportunity that DAS has offered? Not fully! At present the focus of a majority of the players is more investor oriented, not viewer oriented. This has to change. DTH has the potential to grow even more than the predictions of the industry pundits, provided they get their act together in coming out with packaging – as has Dish TV to a limited extent. India is a price sensitive market, offer the viewers what they want at a reasonable price and the sheer volumes will bring in more and more moolah.And what happens to profits once the activation fee component goes down.

DTH subscriber growth retards in Q1-16 as per TRAI data | Indian Television Dot Com

Results for Q4-16 (quarter ended 31 March 2016) showed a reversal of sorts in that trend. Dish TV announced that it had added 5 lakh subscribers – the highest additions in fiscal 2016. Airtel DTH and Videocon d2h added 6.19 lakh and 5.9 lakh subscribers respectively and each reported approximately 11 percent quarter-over-quarter (q-o-q) growth in operating profits in that quarter.It may be noted that TRAI (Telecom Regulatory Authority Regulatorreports for Q3-16 (quarter ended 31 December 2015) of the net active subscriber base included temporarily suspended subscribers that have been inactive for not more than 120 days – hence reflecting a huge 36 percent growth in active subscribers for that quarter.

Besides Airtel DTH, Dish TV and Videocon d2h, there are three other private DTH players in India – Reliance, Sun Direct and Tata Sky, and the government’s FreeDish. Airtel DTH, Dish TV and Videocon d2h (the three players in this report) represent about 65 percent of the private DTH active subscriber universe in India.

FreeDish DTH service – the largest DTH player by far in terms of subscribers with an estimated 15 million or 1.5 crore subscribers in 2015 as per the KPMG-FICCI Indian Media and Entertainment Industry Report 2016 (KPMG-FICCI M&E Report 2016) titled The Future: Now streaming. It must however be noted that an exact number for registered or active subscribers is not available since this is a free DTH service. The proposed merger of Videocon d2h with Dish TV will create the largest private television carriage player in India and the second largest in the world, be it cable, internet television or DTH or any other.

As per numbers released by TRAI for Q4-16 and the quarter ended 30 June 2016 (Q1-17), the growth of registered and active DTH subscribers has reduced from 4.5 percent and 4.6 percent in Q4-16 to 3.3 percent and 3.4 percent respectively in Q1-17. Overall, DTH active subscribers grew by 19.7 lakh or 8.06 percent q-o-q in Q1-17 to 605 lakh active subscribers (66 percent of registered subscribers) from 585.3 lakh (also 66 percent of registered subscribers) in Q4-16. The three players in this report contributed a combined 12.95 lakh or 65.74 percent in subscriber growth. Registered subscriber numbers were 915.3 lakh and 886.4 lakh in Q1-17 and Q4-16 respectively. In Q3-16, registered subscribers were 848 lakh.

In Q1-17, 4.65 lakh (3.97 percent growth), 4 lakh (2.76 percent growth) and 4.3 lakh (3.6 percent growth) were added q-o-q by Airtel DTH, Dish TV and Videocon d2h respectively.

Among the three, Airtel DTH added more net subscribers in absolute numbers in FY-16 than in FY-15, Dish TV added approximately the same number of net subscribers in both FY-15 and FY-16, while Videocon d2h saw slightly lower absolute net subscribers increment in FY-16 as compared to FY-15. Airtel DTH added 55.6 percent more subscribers in FY-16 – 16.52 lakh to reach net subscriber base of 117.52 lakh as compared to 10.62 lakh in FY-15; Dish TV added 15 lakh subscribers in FY-16 as well as in the previous year; Dish TV’s subscriber base was 145 lakh in FY-16; Videocon d2h added 16.8 lakh subscribers in FY-16 to reach a subscriber base of 118.6 lakh as compared to 17.4 lakh subscriber additions in FY-15. The above numbers are based on the financial results/investor presentations reported by the three DTH entities.

ARPU has been steadily increasing in the case of Airtel DTH and Videocon d2h, while it has was constant in the case of Dish TV at Rs 174 in Q4-16 as well as Q1-17. In Q2-17, however, Dish TV’s ARPU has dipped q-o-q by a huge Rs 12 to Rs 162.

For the first time in Q1-17, despite having the largest subscriber base amongst the top three, Dish TV’s revenues have been the lowest. In Q2-17, Airtel DTH reported the highest revenue amongst the three followed by Dish TV, with Videocon d2h’s revenue lower by just a few crore rupees. This could be mainly because Dish TV is more of a value player, whilst the other two are premium players. It may be noted Videocon d2h’s ARPU in Q2-17 has also dipped q-o-q by Rs 10 to Rs 209. Please refer to Fig C below for revenue and ARPU trends (Revenue numbers have been rounded off to the nearest Rs crore, ARPU numbers are in Indian Rupees, Rs)

Let us see how the three have performed in Q1-17

Airtel DTH

Revenue from Airtel’s DTH segment in Q1-17 increased 22.2 per cent to Rs 836.9 crore as compared to Rs 684.8 crore in the corresponding quarter of the previous year. Airtel’s DTH segment reported EBIT (Earnings before interest and tax) of Rs 121.9 crore (14.6 per cent operating margin) in Q1-17 as compared to EBIT of Rs 41.5 crore (6.1 percent operating margin) in Q1-16.

Airtel DTH added 4.24 lakh net subscribers in Q1-17 to bring its subscriber base to 121.9 lakh from 117.25 lakh in the previous quarter. Average revenue per user (ARPU) increased to Rs 233 from Rs 229 in the immediate trailing quarter. Airtel DTH reported a monthly subscriber churn of 0.8 percent in Q1-17, same as the churn in Q1-16 and Q4-16.

Dish TV

Dish TV reported 6.7 percent higher y-o-y subscription revenue of Rs 728.2 crore for Q1-17, as compared to Rs 682.8 crore. Operating revenue in Q1-17 increased 5.7 percent y-o-y to Rs 778.6 crore from Rs 736.7 crore in the corresponding quarter of the previous year.

Dish TV says that:

(1.1) For Q1-17, subscription revenue, on a like-to-like basis, was Rs 766.9 crore, a growth of 12.3 percent y-o-y.

(1.2) For Q1-17 operating revenue, on a like-to-like basis, was Rs 817.2 crore, a growth of 10.9 percent y-o-y.

Dish TV reported PAT of Rs. 40.9 crore in Q1-17, down 24.5 percent as compared to Rs 54.2 crore in Q1-16.

EBIDTA in the Q1-17 increased 12.2 percent to Rs 264.6 crore from Rs 235.7 crore in Q1-16.

The company reported addition of 4.02 lakh net subscribers for Q1-17. It closed the quarter with 149 lakh subscribers. Average revenue per user (ARPU) for Q1-17 remained the same year-over-year (y-o-y) and quarter-over-quarter (q-o-q) at Rs 174.

Videocon d2h

Videocon d2h is the second listed Indian DTH player to report a profit after tax (PAT), after the Essel group’s Dish TV that turned the numbers black last year. Videocon d2h reported PAT of Rs 2.7 crore for Q1-17. For the corresponding year ago quarter (Q1-17), the company had reported a loss of Rs 24.4 crore and for the immediate trailing quarter (Q4-16) reported loss was Rs 21.2 crore.

Videocon d2h subscription and activation revenue in Q1-17 increased 23.9 percent y-o-y to Rs 752.3 crore from Rs 607.3 crore and increased 6.6 percent q-o-q from Rs 705.6 crore.

The DTH major also reported 15.5 percent year-over-year (y-o-y) growth in net subscriber number growth at 122.9 lakh for Q1-17 as compared to 106.4 lakh and a 3.6 percent quarter-over-quarter (q-o-q) growth from118.6 lakh. Average revenue per user (ARPU) in Q1-17 increased to Rs 219 from Rs 205 in Q1-16 and from Rs 214 in the immediate trailing quarter.

Subscriber monthly churn in the current quarter was 0.49 percent; in Q1-16 it was slightly lower at 0.46 percent, while in the immediate trailing quarter it was much higher at 0.58 percent.

Comments

There is not much of a change in the comments and conclusions drawn by us for FY-16 numbers. Overall, the pay DTH industry is turning profitable as is obvious from the results.

DAS III and IV were/are sunshine periods for the television carriage industry. Activation revenues have been adding to the top lines and bottom lines of most of the players. Have they been able to optimise the opportunity that DAS has offered? Not fully! At present the focus of a majority of the players is more investor oriented, not viewer oriented. This has to change. DTH has the potential to grow even more than the predictions of the industry pundits, provided they get their act together in coming out with packaging – as has Dish TV to a limited extent. India is a price sensitive market, offer the viewers what they want at a reasonable price and the sheer volumes will bring in more and more moolah.And what happens to profits once the activation fee component goes down.

DTH subscriber growth retards in Q1-16 as per TRAI data | Indian Television Dot Com