- Joined

- 16 May 2011

- Messages

- 21,065

- Reaction score

- 30,271

It looks like a good idea. From October this year, television channels will be forced to keep advertising time to a maximum of 12 minutes every hour of programming against the 14-25 minutes that many channels now do. This will make you and me happy as viewers. It could also make broadcasters happy as reduced supply could force prices up. Most media buyers are predicting a double-digit growth in television advertising against a dismal 7 per cent last year. Why then is everyone in the television broadcast business so glum?

"Ten plus two (ten minutes for paid commercials and two for in-house promos) is a good idea but it is very opportunistically timed. It will benefit large broadcasters and networks," says Satyajit Sen, chief executive, Zenith Optimedia, a media consultancy. Sen has hit the nail on the head. The top five networks-Star, Sony, Sun, Zee and Network18-control just over 65 per cent of the total viewing time spent on television. Their ability to withstand any reduction in advertising inventory by upping rates and sticking to them is high. For instance, Sun TV's rates have already gone up 20-30 per cent in July, says Sen. That is roughly the increase predicted for the rest of the Rs 39,000-crore (ad plus pay revenues) television industry. "The extent of increase in rates will vary across genre," reckons Punit Goenka, managing director and CEO, Zee.

The big issue, however, is one of "timing, not principle," says Rohit Gupta, president (network sales), Sony. That is because the 12-minute rule can work successfully only in tandem with digitisation. Pushing through its implementation before all of India's 153-million-TV homes have gone digital could marginalise or kill scores of smaller broadcasters and networks, especially in commoditised genres such as news, music or movies. Almost all of them are totally ad dependent. Till digitisation happens, there is no scope to generate pay revenues. But if the 12-minute rule pushes rates up, advertisers are likely to go to the top two-three networks with the largest audience share. This double whammy-no pay revenues and deserting advertisers-will leave the smaller channels with little choice but to shut down.

This, then, is where the happy story of the 12-minute rule begins to unravel.

Badly timed?

A fragmented market, leaky distribution structure, bandwidth constraints and price regulation have hobbled both advertisement and pay revenue growth for the industry. Of the two, the industry's dependence on ad revenue is very high. Globally, pay brings in 50-70 per cent of a broadcaster's topline. In India, this number is 15-20 per cent. One reason for this is the limitation on cable capacity (DTH homes have no such constraint).

An amendment to the Cable Act in 2011 has mandated digitisation, or compressing analog signals to increase the capacity of the existing cable pipes by 10 to 14 times. It is by far the single biggest policy change in the TV business in the 22 years since CNN first came to India. This is because in the long run, it eliminates carriage fees, charged just to carry a channel on the clogged cable system. It also increases pay revenues since all homes on a cable system are visible. So distributors and cable operators have to share revenues on every home reached.

The deadline for mandatory digitisation is December 2014. However, given the on- ground implementation issues, most analysts expect the effects of digitisation, in the form of better pay revenues and, therefore, less dependence on advertising, to start kicking in only by 2016-17. Once that happens, the nature of the game will change.

A pay market with plenty of capacity demands that broadcasters pander to viewers not advertisers. And that will mean cutting back on ad inventory or having ad-free channels. India's broadcast regulator, TRAI or Telecom Regulatory Authority of India, envisages this. That is why, any channel that is only on the digital platform is not under price control, according to N. Parameswaran, principal advisor (consumer affairs), TRAI. This means niche channels can find small clusters of audiences and charge them higher prices to pay for specialised content. In that case, any limit on ad time would not matter.

If digitisation is fully operational by 2016, pay revenues will go up and costs, especially of carriage, will fall, leaving smaller channels with more resources to invest in content. That could be a better time to implement the 12-minute rule.

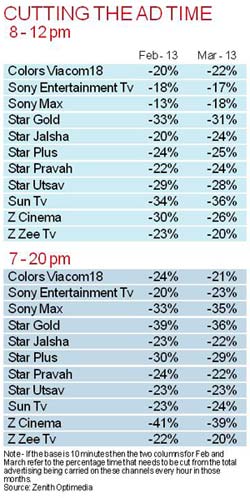

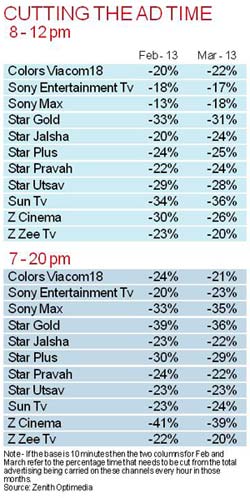

TRAI and the ministry of information and broadcasting, however, are insisting on implementing it now. In March this year, TRAI issued a notification on Standards of Quality of Service on the 12-minute rule, which has always been part of the advertising code under the Cable Act. TRAI is enforcing it now as complaints from consumer organisations have piled up, and justifiably so. Any analysis of ad time per hour will show that most broadcasters are anywhere from 20-35 per cent over the 12-minute norm.

Rising rates

The ambiguity of a just-digitising market combined with regulatory pressure on the ad time has brought advertisers and broadcasters at loggerheads over ratings. TAM Media Research, the firm that comes out with television ratings data recently increased its coverage of smaller towns, resulting in some of the big networks showing lower reach numbers. By unsubscribing from the service en masse, the big broadcasters are hoping that advertisers will not have a negotiating tool to keep ad rates down. Advertisers, meanwhile, are insisting that TAM figures be used till an alternative is found.

For all this jostling, ad rates may not actually go up, says one set of broadcasters. In private meetings, large FMCG advertisers, the big spenders on TV, are reported to be unhappy with the idea. Most have been increasing their print spends as language newspapers, reeling under price wars, have been cutting ad rates. The whole print plus activation (or through the social media) gives them better returns in small towns. So why not increase that and reduce the cumulative reach they seek on television? Ford, for instance, does not spend much on television. It has already pushed its digital budget to double digits this year and will "rethink its plan" based on the new rule, says Vinay Piparsania, executive director (marketing and sales), Ford India. It may be a good idea in the long run. But for now the 12-minute whip will end up forcing advertisers to rethink television.

Gone in twelve minutes | Business Standard

.

"Ten plus two (ten minutes for paid commercials and two for in-house promos) is a good idea but it is very opportunistically timed. It will benefit large broadcasters and networks," says Satyajit Sen, chief executive, Zenith Optimedia, a media consultancy. Sen has hit the nail on the head. The top five networks-Star, Sony, Sun, Zee and Network18-control just over 65 per cent of the total viewing time spent on television. Their ability to withstand any reduction in advertising inventory by upping rates and sticking to them is high. For instance, Sun TV's rates have already gone up 20-30 per cent in July, says Sen. That is roughly the increase predicted for the rest of the Rs 39,000-crore (ad plus pay revenues) television industry. "The extent of increase in rates will vary across genre," reckons Punit Goenka, managing director and CEO, Zee.

The big issue, however, is one of "timing, not principle," says Rohit Gupta, president (network sales), Sony. That is because the 12-minute rule can work successfully only in tandem with digitisation. Pushing through its implementation before all of India's 153-million-TV homes have gone digital could marginalise or kill scores of smaller broadcasters and networks, especially in commoditised genres such as news, music or movies. Almost all of them are totally ad dependent. Till digitisation happens, there is no scope to generate pay revenues. But if the 12-minute rule pushes rates up, advertisers are likely to go to the top two-three networks with the largest audience share. This double whammy-no pay revenues and deserting advertisers-will leave the smaller channels with little choice but to shut down.

This, then, is where the happy story of the 12-minute rule begins to unravel.

Badly timed?

A fragmented market, leaky distribution structure, bandwidth constraints and price regulation have hobbled both advertisement and pay revenue growth for the industry. Of the two, the industry's dependence on ad revenue is very high. Globally, pay brings in 50-70 per cent of a broadcaster's topline. In India, this number is 15-20 per cent. One reason for this is the limitation on cable capacity (DTH homes have no such constraint).

An amendment to the Cable Act in 2011 has mandated digitisation, or compressing analog signals to increase the capacity of the existing cable pipes by 10 to 14 times. It is by far the single biggest policy change in the TV business in the 22 years since CNN first came to India. This is because in the long run, it eliminates carriage fees, charged just to carry a channel on the clogged cable system. It also increases pay revenues since all homes on a cable system are visible. So distributors and cable operators have to share revenues on every home reached.

The deadline for mandatory digitisation is December 2014. However, given the on- ground implementation issues, most analysts expect the effects of digitisation, in the form of better pay revenues and, therefore, less dependence on advertising, to start kicking in only by 2016-17. Once that happens, the nature of the game will change.

A pay market with plenty of capacity demands that broadcasters pander to viewers not advertisers. And that will mean cutting back on ad inventory or having ad-free channels. India's broadcast regulator, TRAI or Telecom Regulatory Authority of India, envisages this. That is why, any channel that is only on the digital platform is not under price control, according to N. Parameswaran, principal advisor (consumer affairs), TRAI. This means niche channels can find small clusters of audiences and charge them higher prices to pay for specialised content. In that case, any limit on ad time would not matter.

If digitisation is fully operational by 2016, pay revenues will go up and costs, especially of carriage, will fall, leaving smaller channels with more resources to invest in content. That could be a better time to implement the 12-minute rule.

TRAI and the ministry of information and broadcasting, however, are insisting on implementing it now. In March this year, TRAI issued a notification on Standards of Quality of Service on the 12-minute rule, which has always been part of the advertising code under the Cable Act. TRAI is enforcing it now as complaints from consumer organisations have piled up, and justifiably so. Any analysis of ad time per hour will show that most broadcasters are anywhere from 20-35 per cent over the 12-minute norm.

Rising rates

The ambiguity of a just-digitising market combined with regulatory pressure on the ad time has brought advertisers and broadcasters at loggerheads over ratings. TAM Media Research, the firm that comes out with television ratings data recently increased its coverage of smaller towns, resulting in some of the big networks showing lower reach numbers. By unsubscribing from the service en masse, the big broadcasters are hoping that advertisers will not have a negotiating tool to keep ad rates down. Advertisers, meanwhile, are insisting that TAM figures be used till an alternative is found.

For all this jostling, ad rates may not actually go up, says one set of broadcasters. In private meetings, large FMCG advertisers, the big spenders on TV, are reported to be unhappy with the idea. Most have been increasing their print spends as language newspapers, reeling under price wars, have been cutting ad rates. The whole print plus activation (or through the social media) gives them better returns in small towns. So why not increase that and reduce the cumulative reach they seek on television? Ford, for instance, does not spend much on television. It has already pushed its digital budget to double digits this year and will "rethink its plan" based on the new rule, says Vinay Piparsania, executive director (marketing and sales), Ford India. It may be a good idea in the long run. But for now the 12-minute whip will end up forcing advertisers to rethink television.

Gone in twelve minutes | Business Standard

.