- Joined

- 16 May 2011

- Messages

- 21,066

- Reaction score

- 30,271

BRIC countries — Brazil, Russia, India, China — are driving the pay-TV revenue and subscribers, said Infonetics Research.

Pay-TV subscribers reached 730 million in 2012, up 7 percent from the previous year.

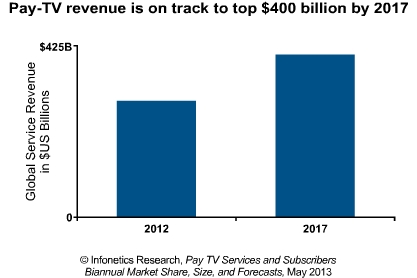

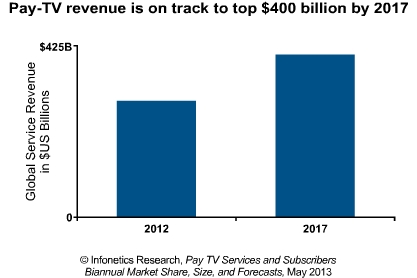

Pay-TV providers revenue rose 10 percent to $287 billion worldwide in 2012 against 2011.

Infonetics Research report suggests that Comcast, Time Warner Cable, and UPC need new strategies to win in the pay TV market.

To stem the subscriber losses, incumbent MSOs including Comcast, Time Warner Cable, and UPC are introducing new services, like home automation and multi-screen video to reduce subscriber churn and generate top-line revenue growth, in addition to deploying new technologies to lower the capex required to deliver broadcast video.

“Thanks to strong momentum mostly in the BRIC countries — Brazil, Russia, India, China — pay-TV revenue and subscribers continue to grow in the face of mounting cable subscriber losses in North America and Western Europe, where pay-TV providers are in danger of being relegated to the role of content aggregator,” said Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research.

Pay-TV providers revenue — from cable and satellite pay TV and telecoms IPTV services — rose 10 percent to $287 billion worldwide in 2012 against 2011.

Infonetics said cable makes up the largest portion of the pay-TV market, but this will change by 2017 when satellite grows to more than 40 percent of total pay-TV revenue.

Telecoms IPTV revenue is growing fastest among the 3 pay-TV segments, forecast by Infonetics to grow at a 19 percent CAGR through 2017.

Pay-TV subscribers reached 730 million in 2012, up 7 percent from the previous year.

In 2012, digital cable pay-TV subscribers outnumbered analog subscribers for the first time, bolstered by European Union’s transition from analog to digital.

DirecTV and Comcast are leading the pay TV market. DirecTV has the highest ARPU, while Comcast has the most subscribers, according to Infonetics Research.

Meanwhile, ABI Research earlier said that the pay-TV market generated $238 billion in 2012 against $223 billion in 2011. By 2018, the global pay-TV market is expected to generate $304 billion in 2018 with a CAGR of 4 percent.

ABI Research also reported that service revenue contributions from cable TV are proving mixed. The Asia-Pacific region saw service revenue growth due to underlying increase in subscriptions. However, cable TV operators in North America are experiencing a decline in service revenue as a result of a contracting subscriber base, despite cable TV innovations such as DVR and HDTV.

Pay-TV revenue up 10%, users up 7%, driven by India, China, Brazil, Russia: Infonetics

.

Pay-TV subscribers reached 730 million in 2012, up 7 percent from the previous year.

Pay-TV providers revenue rose 10 percent to $287 billion worldwide in 2012 against 2011.

Infonetics Research report suggests that Comcast, Time Warner Cable, and UPC need new strategies to win in the pay TV market.

To stem the subscriber losses, incumbent MSOs including Comcast, Time Warner Cable, and UPC are introducing new services, like home automation and multi-screen video to reduce subscriber churn and generate top-line revenue growth, in addition to deploying new technologies to lower the capex required to deliver broadcast video.

“Thanks to strong momentum mostly in the BRIC countries — Brazil, Russia, India, China — pay-TV revenue and subscribers continue to grow in the face of mounting cable subscriber losses in North America and Western Europe, where pay-TV providers are in danger of being relegated to the role of content aggregator,” said Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research.

Pay-TV providers revenue — from cable and satellite pay TV and telecoms IPTV services — rose 10 percent to $287 billion worldwide in 2012 against 2011.

Infonetics said cable makes up the largest portion of the pay-TV market, but this will change by 2017 when satellite grows to more than 40 percent of total pay-TV revenue.

Telecoms IPTV revenue is growing fastest among the 3 pay-TV segments, forecast by Infonetics to grow at a 19 percent CAGR through 2017.

Pay-TV subscribers reached 730 million in 2012, up 7 percent from the previous year.

In 2012, digital cable pay-TV subscribers outnumbered analog subscribers for the first time, bolstered by European Union’s transition from analog to digital.

DirecTV and Comcast are leading the pay TV market. DirecTV has the highest ARPU, while Comcast has the most subscribers, according to Infonetics Research.

Meanwhile, ABI Research earlier said that the pay-TV market generated $238 billion in 2012 against $223 billion in 2011. By 2018, the global pay-TV market is expected to generate $304 billion in 2018 with a CAGR of 4 percent.

ABI Research also reported that service revenue contributions from cable TV are proving mixed. The Asia-Pacific region saw service revenue growth due to underlying increase in subscriptions. However, cable TV operators in North America are experiencing a decline in service revenue as a result of a contracting subscriber base, despite cable TV innovations such as DVR and HDTV.

Pay-TV revenue up 10%, users up 7%, driven by India, China, Brazil, Russia: Infonetics

.