Hungama and Super Hungama were loved for Shinchan — but are redundant amongst several Disney and Nick channels

Coming to the kids’ genre, both Hungama and Super Hungama are among India’s oldest kids’ channels, being launched by the then-Disney India back in 2004 — the same year as Disney Channel — long before Disney acquired Star in 2019. While Disney Channel and Hungama have kept the same name throughout, the present-day Super Hungama has undergone several renamings: originally Toon Disney/Jetix (2004), then Disney XD (2009), then Marvel HQ (2019) and finally Super Hungama since 2022. Indeed, Hungama celebrated its 20th birthday in September 2024, but there might not be any cause for celebration for much longer as its days could well be numbered.

Over the years, Hungama had been strongly associated with the Japanese cartoons Shinchan and Doraemon — much like Pogo from Warner Bros. Discovery is known for Chhota Bheem, or Viacom18’s Nick for Motu Patlu and Pakdam Pakdai. However, Culver Max’s kids’ channel Sony YAY! announced on its 7th birthday in April 2024 that it would be the new Indian home of Shinchan going forward. And so, Hungama’s marquee property was snatched from its grasp, depriving the channel of much of its purpose, while Sony YAY! bagged another big catch years after the French cartoon Oggy and the Cockroaches, another favourite of Indian kids.

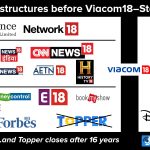

With the union of Disney Star’s kids’ channels (using the Disney and Hungama brands) with Viacom18’s Nickelodeon-branded channels — Nick, Nick HD+, Nick Jr. and Sonic — the combined broadcaster will be unassailable in the kids’ genre, leaving Warner Bros. Discovery (Pogo, Cartoon Network, Discovery Kids) far behind. Other broadcasters either have only one kids’ channel — Sony YAY!, IN10 Media’s Gubbare and CBeebies from the BBC being examples — or, in the case of the Sun and ETV networks, have multiple versions of the same kids’ channel (ETV Bal Bharat in the latter case) in various languages. As such, the two Hungama channels are increasingly redundant after the Disney and Nick brands unite, and so will likely come to an end after two decades.

Other regional languages are spared from the CCI’s scanner, plus all Hindi, English and sports channels

Note that these seven channels are only a small selection out of more than 100 channels from the combined broadcaster, often with over 10 channels in some genres like Hindi movies — not to mention a massive 22 in sports, with 17 from Star Sports alone, including 7 HD and five regional channels. However, none of these genres have been flagged by the CCI at this stage. Its calculations to establish Star and Viacom18’s dominance in a particular genre did not cross its self-defined threshold of 40% for these genres, as it did for Bengali, Marathi, Kannada and kids’ channels. Nevertheless, one cannot discount the possibility of some redundant Hindi movie channels (for example, Colors Cineplex Superhits or Star Utsav Movies) or sports channels (like Star Sports First or Sports18 3) being sold or closed, though that is mere speculation at this stage.

Moreover, there are other regional languages where both broadcasters are present, namely Tamil and Odia, but Star and Viacom18 are not as dominant in these languages as they will be in Bengali, Marathi and Kannada. In Tamil, Star Vijay is usually among BARC’s top 10 most-watched channels nationally — even though it’s a long way behind Sun TV, which is rarely outside the top three. But Colors Tamil is much less successful, and in fact it might be selected for closure at a later stage, over and above the CCI’s directives. In Odia, on the other hand, both Star Kiran (launched in 2022) and Colors Odia are abject failures in contrast to the leadership of Ortel Communications’ Tarang TV, closely followed by Zee Sarthak. Yet the CCI has not chosen them as part of its divestment requirements, due to Star and Viacom18 together not forming more than 40% of the respective market shares.

There are yet more languages where only one of the two broadcasters is present and enjoys a leadership position in that language. Notably, Star Maa in Telugu is consistently one of the top 5 most-watched channels in India as per BARC’s weekly ratings, with Zee Telugu also making the top 10. (For the purpose of this article, Eenadu TV (ETV) is considered to be an independent Telugu broadcaster and not a part of Viacom18, even though Reliance has a nearly 25% stake in it.) Disney Star’s main Malayalam channel, Asianet, is similarly the numero uno in its language, leaving the second-placed Zee Keralam and other competitors like Mazhavil Manorama far behind. On the other hand, Colors Gujarati and Colors Gujarati Cinema together enjoy a complete monopoly, since all other private Gujarati satellite channels are either news channels — including Network18’s CNBC Bajar, the only regional business channel — or Hindu devotional channels.

Conclusion: There might be some more channel closures — but Reliance and Disney will try to minimise them

All things considered, the combined Star–Viacom18 broadcaster has been trying to optimise its resources, while trying to avoid the shutdowns of as many channels as possible in order to comply with frozen ad rates and get the most out of airing ads on its existing channels. It cannot get away with increasing ad rates for marquee properties like the IPL, as then it would command such a high premium that other broadcasters like Zee and Sony would be adversely affected. That said, the closure or sale of some channels is inevitable due to the considerable overlap in many genres, and the CCI’s announcement is a timely — if surprising (or shocking, in the case of Jalsha Movies) — reminder of just how money-rich, powerful and near-monopolistic a broadcaster Disney Star–Viacom18 is shaping up to be.

384 replies

Loading new replies...

Join the full discussion at the DreamDTH Forums →