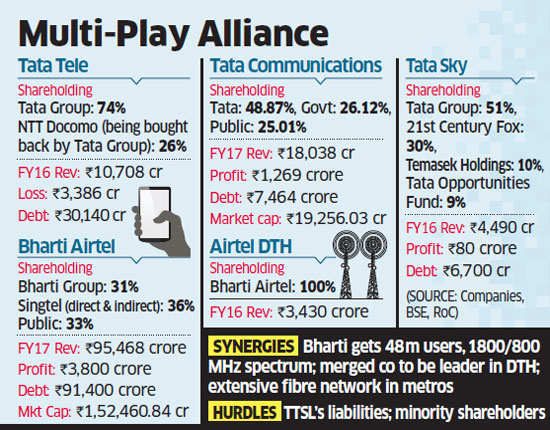

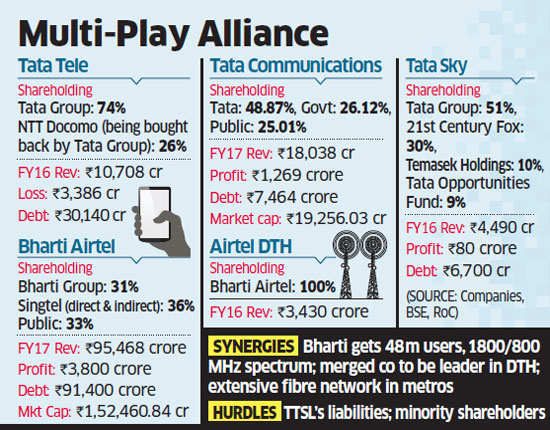

Discussions between both sides have revolved around a possible merger between unlisted Tata TeleservicesBSE 7.52 % and Tata Sky and the listed Tata CommunicationsBSE 0.64 % with the Sunil Mittal-owned Bharti AirtelBSE 0.89 %, which includes its wholly owned DTH arm, these people added.

Combined benefits

The combined enterprise business segment of Tata Communications and Bharti Airtel are at par when it comes to revenue, but the quality of customers and intra-city cable network of Tata Communications is far wider. As the first mover in many markets Tata Communications holds the key to lucrative customers who with Airtel’s sales prowess could expand consumption. Tata Communications is a profit making entity with its most expensive assets – optic fibre cables – already amortized, or paid for. This is a synergy Airtel would most look forward to because expanding infrastructure for corporate customers is expensive, say analysts. With synergies between Tata Communications and Airtel, the two companies will create capacity for nearly twice the number of customers that they are currently serving, they add.

India’s DTH market comprises 61.2 million users with four players competing neck to neck for top position, with Dish TV leading the pack with 25% subscriber market share, followed by Tata Sky, with 23% and Airtel with 21%. That said Tata Sky is the oldest and most established among them with better satellite capacity.

Read more at:

Tatas, Bharti on a call to explore joint front in telecom and DTH

Combined benefits

The combined enterprise business segment of Tata Communications and Bharti Airtel are at par when it comes to revenue, but the quality of customers and intra-city cable network of Tata Communications is far wider. As the first mover in many markets Tata Communications holds the key to lucrative customers who with Airtel’s sales prowess could expand consumption. Tata Communications is a profit making entity with its most expensive assets – optic fibre cables – already amortized, or paid for. This is a synergy Airtel would most look forward to because expanding infrastructure for corporate customers is expensive, say analysts. With synergies between Tata Communications and Airtel, the two companies will create capacity for nearly twice the number of customers that they are currently serving, they add.

India’s DTH market comprises 61.2 million users with four players competing neck to neck for top position, with Dish TV leading the pack with 25% subscriber market share, followed by Tata Sky, with 23% and Airtel with 21%. That said Tata Sky is the oldest and most established among them with better satellite capacity.

Read more at:

Tatas, Bharti on a call to explore joint front in telecom and DTH