You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Thread starter Sarkar

- Start date

- Replies: Replies 95

- Views: Views 12,689

Situations are not much different in other sectors also. Atleast they hv the capability to repay bank emi unlike many companies like Rcom, Sahara, kingfisher etc

Yes in 80 odd years at the same rate.

Jio is nowhere close to the broadcasting business. They are the slowest in speed also so cannot provide streaming on wireless network and fiber network will not be ready for at least 10 yearsBut bound to happen to counter jio in all division

..

@Gobinaath bro.It is merger.One entity.They will keep both brands

In simple words.Now they are two DTH companies having two brands-Airtel and Tatasky but after merger it will be one company having two brands Airtel and Tatasky. Just like Moto,Lenovo and Zuk are brands of same company

In simple words.Now they are two DTH companies having two brands-Airtel and Tatasky but after merger it will be one company having two brands Airtel and Tatasky. Just like Moto,Lenovo and Zuk are brands of same company

Sai Jai

Contributor

- Joined

- 5 Jan 2015

- Messages

- 23,586

- Reaction score

- 32,144

Jio is nowhere close to the broadcasting business. They are the slowest in speed also so cannot provide streaming on wireless network and fiber network will not be ready for at least 10 years

Yes right for FTTH but they are planning to give service via stb through wired like Fastway , DEN like that

..

@Gobinaath bro.It is merger.One entity.They will keep both brands

In simple words.Now they are two DTH companies having two brands-Airtel and Tatasky but after merger it will be one company having two brands Airtel and Tatasky. Just like Moto,Lenovo and Zuk are brands of same company

I too tell the same bro

Don't go with their words it's only for nature but reality is different in business merger & takeover are different words with different meaning the same time alliance is different it's purely based on temporary agreement they can break up @ any time

But they using the word wrongly as merger .. merge means u can't run the two different brand @ two different names after merging into one

But alliance u can do .. then tell now bro it's merger or alliance ??

..

@Gobinaath bro if its merger then they will transfer to a single company.Shareholders will get share of that company.Alliance is more like a contract of one company with another.Both will have independent operation.

Sai Jai

Contributor

- Joined

- 5 Jan 2015

- Messages

- 23,586

- Reaction score

- 32,144

I hv not seen Jio's copper cable network anywhere in metro like kolkata so no chance in village. Have you seen it?

Nope not in real only in our forum

But soon coming could be after feature volte phone launch or could be both in one day

..

Kittykitty

Member

- Joined

- 6 Jul 2017

- Messages

- 633

- Reaction score

- 331

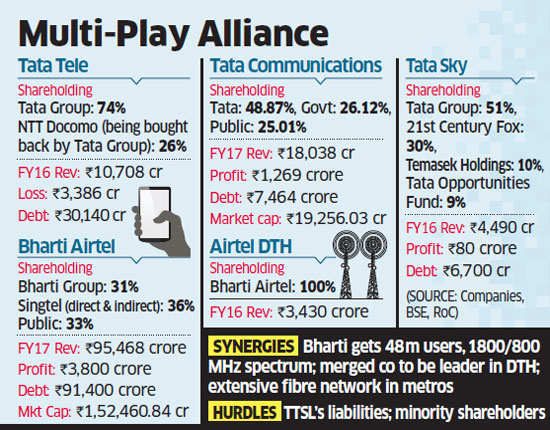

Ini airtel la etuikura channels um Tata sky laium etuikum and Tata sky la etuikura channels airtel aium etuikum ah frdsDiscussions between both sides have revolved around a possible merger between unlisted Tata TeleservicesBSE 7.52 % and Tata Sky and the listed Tata CommunicationsBSE 0.64 % with the Sunil Mittal-owned Bharti AirtelBSE 0.89 %, which includes its wholly owned DTH arm, these people added.

Combined benefits

The combined enterprise business segment of Tata Communications and Bharti Airtel are at par when it comes to revenue, but the quality of customers and intra-city cable network of Tata Communications is far wider. As the first mover in many markets Tata Communications holds the key to lucrative customers who with Airtel’s sales prowess could expand consumption. Tata Communications is a profit making entity with its most expensive assets – optic fibre cables – already amortized, or paid for. This is a synergy Airtel would most look forward to because expanding infrastructure for corporate customers is expensive, say analysts. With synergies between Tata Communications and Airtel, the two companies will create capacity for nearly twice the number of customers that they are currently serving, they add.

India’s DTH market comprises 61.2 million users with four players competing neck to neck for top position, with Dish TV leading the pack with 25% subscriber market share, followed by Tata Sky, with 23% and Airtel with 21%. That said Tata Sky is the oldest and most established among them with better satellite capacity.

Read more at:

Tatas, Bharti on a call to explore joint front in telecom and DTH