Direct to Home (DTH) broadcasting revenues could increase up to Rs 22,000 crore in FY 21 with people continuing to stay at home which could result in revenue growth of 4-6%. CRISIL report states that the industry will buck the economic crisis due to the healthy subscriber additions.

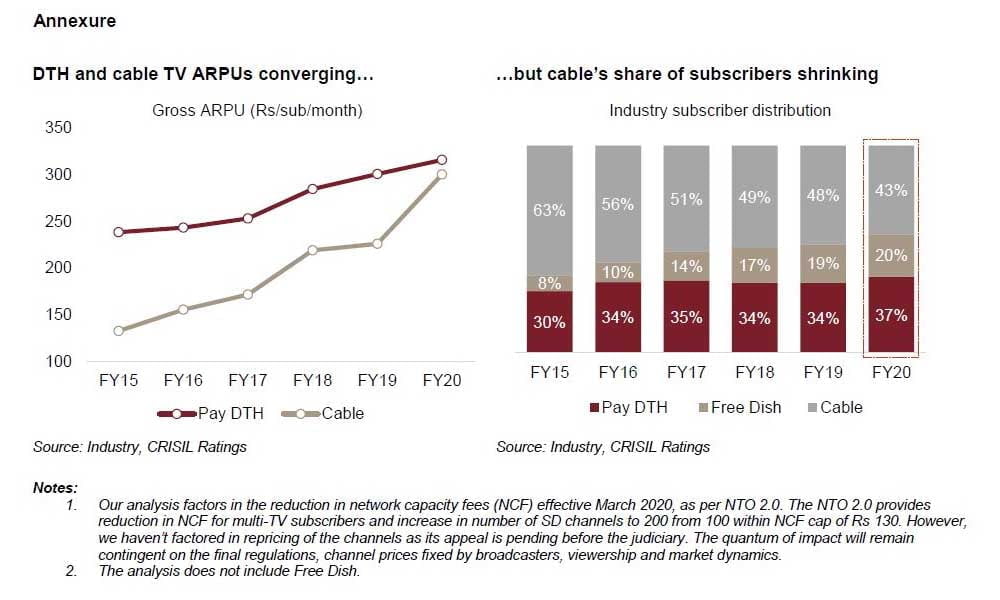

DTH subscriber base has increased post the implementation of NTO 1.0 which has led to cable TV subscriber migrating with DTH operators smoothly transiting to the new system while cable TV operators grappled with the integration. The price parity between MSOs and DTH operators has also eroded the price advantage cable TV had over DTH with a 30-35% increase in cable TV tariffs.

With people spending time at home more than earlier, TV viewership between January-June increased by 9% year-on-year which is likely to remain on track with IPL and airing of new TV serial episodes. Crisil expects TV households to increase which currently stands at 69% in fiscal 2020.

Says Sachin Gupta, Senior Director, CRISIL Ratings, “Last fiscal, the DTH sector saw a healthy revenue growth of ~1,400 bps (~900 bps rise in subscriber base and ~500 bps in average revenue per user, or ARPU). This fiscal, the subscriber base is seen increasing another 600-700 bps to ~68 million, which will lift revenue growth up 400-600 bps. But ARPU is seen contracting 100-200 bps to Rs 310-315 on downtrading1 by viewers and reduction in charges for multi-TV subscribers as per the New Tariff Order 2.0 (NTO 2.0).”

Crisil says that the buzz around OTT wouldn’t affect TV in the medium term with both platforms co-existing as in India TV subscription costs less than half of OTT services. Apart from that, India only has 8% broadband penetration whereas developed countries had 80% penetration with high-speed infrastructure a must for good OTT content watching experience.

Says Nitesh Jain, Director, CRISIL Ratings, “To be sure, the increasing popularity and rapid proliferation of OTT platforms is a cause for concern for TV segment. But TV will continue to hold sway over the medium term for three reasons: conducive demographics, low penetration, and, most importantly, low cost. OTT will become a material threat only when its cost becomes equal to, or cheaper than, TV subscription, and internet connectivity improves to ensure consistently comparable quality of viewing experience.”

It should be happen na. Trai help them to increase ARPU at least 130 to 160 per users and pick the pocket of customers