Ever since a corporate restructuring in 2022 — which saw the launch of the Sports18 TV channels, and the repositioning of the JioCinema streaming platform (replacing Voot) as an all-in-one, free, ad-supported digital content destination — Reliance Industries-owned broadcaster Viacom18 has gone full throttle in terms of acquiring new sports properties. These range from the 2022 FIFA World Cup in Qatar, to the BCCI Indian cricket rights and the Women’s Premier League, to the Indian Super League in football, to multiple European football leagues — with the crown jewel of them all being the digital rights of the Indian Premier League, the satellite rights being with Star Sports. The latest example is the Paris Summer Olympics, which kicked off on 26 July 2024 (Friday) and will run until 11 August (Sunday).

However, Reliance has overwhelmingly focused its attention on the JioCinema streaming service, with only the bare minimum of Olympics coverage on the Sports18 channels. This is clearly a move to drive even more viewers to the free-of-cost OTT platform, whose Olympics offering boasts of 17 concurrent, multilingual feeds for covering simultaneous events — a must for the Olympic Games — plus three curated feeds with commentary, with all 20 available in 4K. At the other extreme, there are barely five Sports18 channels — Sports18 1, 1 HD, 2, 3 and Khel (the last is confined to DD Free Dish and Dish TV NSS6/SES8) — with only one HD channel, which is laughably inadequate. This leaves linear TV viewers, many of whom lack high-speed Internet access, starved of important action-packed events that only JioCinema can provide.

The resources of a broadcaster as money-rich and ambitious as Reliance should have meant that both linear TV and streaming viewers receive equal access to events, but such has not turned out to be the case, especially since there is only a single HD channel (Sports18 1 HD) for the Olympics. Moreover, all the emphasis on the multiple event feeds, expert analysis, and ‘Asli 4K’ transmission on JioCinema clearly makes the Sports18 channels’ coverage an afterthought. (While the opening ceremony was telecast on Viacom18’s Colors-branded channels as well as the music channels MTV and Vh1, none of them have aired any of the subsequent coverage, overburdening the Sports18 channels. This is in contrast to the 2022 FIFA World Cup in Qatar, which was broadcast on both the Sports18 network and niche channels like MTV HD.)

In stark comparison, Sony Pictures Networks — the previous Indian broadcaster of both the FIFA World Cup (2018, in Russia) and the Summer Olympics (2021, in Tokyo) — ensured that both the Sony Ten (now Sony Sports Ten) channels and the SonyLIV streaming service had multiple feeds (plus several HD channels) in different languages, leaving all viewers well catered for. Indeed, Sports18’s current rival Star Sports has a whopping 17 channels on air at present — not to mention Disney+ Hotstar’s continuous coverage of major sporting events — but now that Viacom18 and Disney Star have agreed to a joint venture, which was announced in February 2024 and will go through an approval and scrutiny process in the coming months, this equation will change drastically once the Ambani- and Disney-owned broadcasters join forces.

This continues a worrying trend — but the story could shift if Viacom18 merges with Disney Star successfully

Viacom18’s policy of championing JioCinema as an all-encompassing hub for all sports events — not least because the OTT service is named after the Jio telecom network — is a worrying policy for those who rely on linear TV without widespread access to high-speed internet. All the more so because the broadcaster has a dedicated offering for DD Free Dish viewers, Sports18 Khel — also unofficially available on Dish TV (specifically the NSS6/SES8 satellites for North Indian viewers) — which has also been airing the Paris Olympics. Neither Star nor Sony, which broadcast the Rio Olympics in 2016 and the Tokyo Olympics in 2021 respectively, spared any expense in their broadcast and digital coverage.

In fact, this was Viacom18’s approach even for the 2022 FIFA World Cup, the first major quadrennial sporting event — the Paris Olympics being the second — to be aired on Sports18 and JioCinema, with the latter getting far more attention than the former. Non-sports channels, like MTV HD, had to be roped in to show smaller matches, while the main Sports18 1 HD channel remained missing from most DTH operators until just a few days before the start of the World Cup. Reliance acquired the broadcast and digital rights for the Paris Olympics in late December 2022, shortly after Argentina won the FIFA World Cup, and naturally this was a huge win for Viacom18 and JioCinema in particular — especially since the World Cup had thrust JioCinema into the spotlight.

This is in stark contrast to the IPL, where JioCinema’s studio analysis, real-time statistics and live interaction with fans and presenters has been matched by Star Sports’ elaborate broadcast coverage, including ‘red-button’ interactive services on Tata Play and Airtel Digital TV — and, for the 2024 edition of the IPL, even a Star 4K feed on these two DTHs and Sun Direct. That doesn’t even account for the comprehensive broadcast coverage of the IPL and other cricket events (like the ICC Men’s ODI and T20 World Cups) across not only over a dozen Star Sports channels (including regional channels) and multiple HD channels, but also Hindi and regional movie channels.

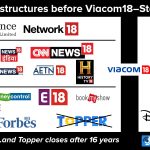

However, should the joint venture between these two competing broadcasters be finalised — with The Walt Disney Company holding about a third, and Viacom18 (to be renamed as Digital18) and its parent Reliance Industries each holding the rest — the burgeoning JioCinema and the hitherto restricted Sports18 network will likely be integrated with the Disney+ Hotstar and the colossal Star Sports network of channels, respectively. Their contrasting approaches — Viacom18 overwhelmingly focused on JioCinema while sidelining broadcast TV, and Disney Star believing in the power of television’s reach and scale while simultaneously bolstering its digital reach — will then combine to create a colossus of epic proportions, especially in sports, far ahead of the reach of the rest.

15 replies

Loading new replies...

Join the full discussion at the DreamDTH Forums →