Ashok Varma

Contributor

- Joined

- 20 Sep 2018

- Messages

- 1,651

- Reaction score

- 2,372

STAR's main assets are in linear TV, RIL might not dare to acquire major stake @$10B valuation just for Hotstar as no growth in Linear TV due to NTO pricing restrictions.Disney may choose the Sony way for sports & ott. Throttle aggressive aquisitions and investments in sports. May give up the race to Viacom 18 and stay in the second line with minimal properties. On the other hand TV entertainment go same and they may continue studio/production buisness with careful investments.

Due to its massive size Star is not affordable for most Indian investors, except few like Reliance. Most foreign MNCs facing recession so that no one dare to spend money in India.

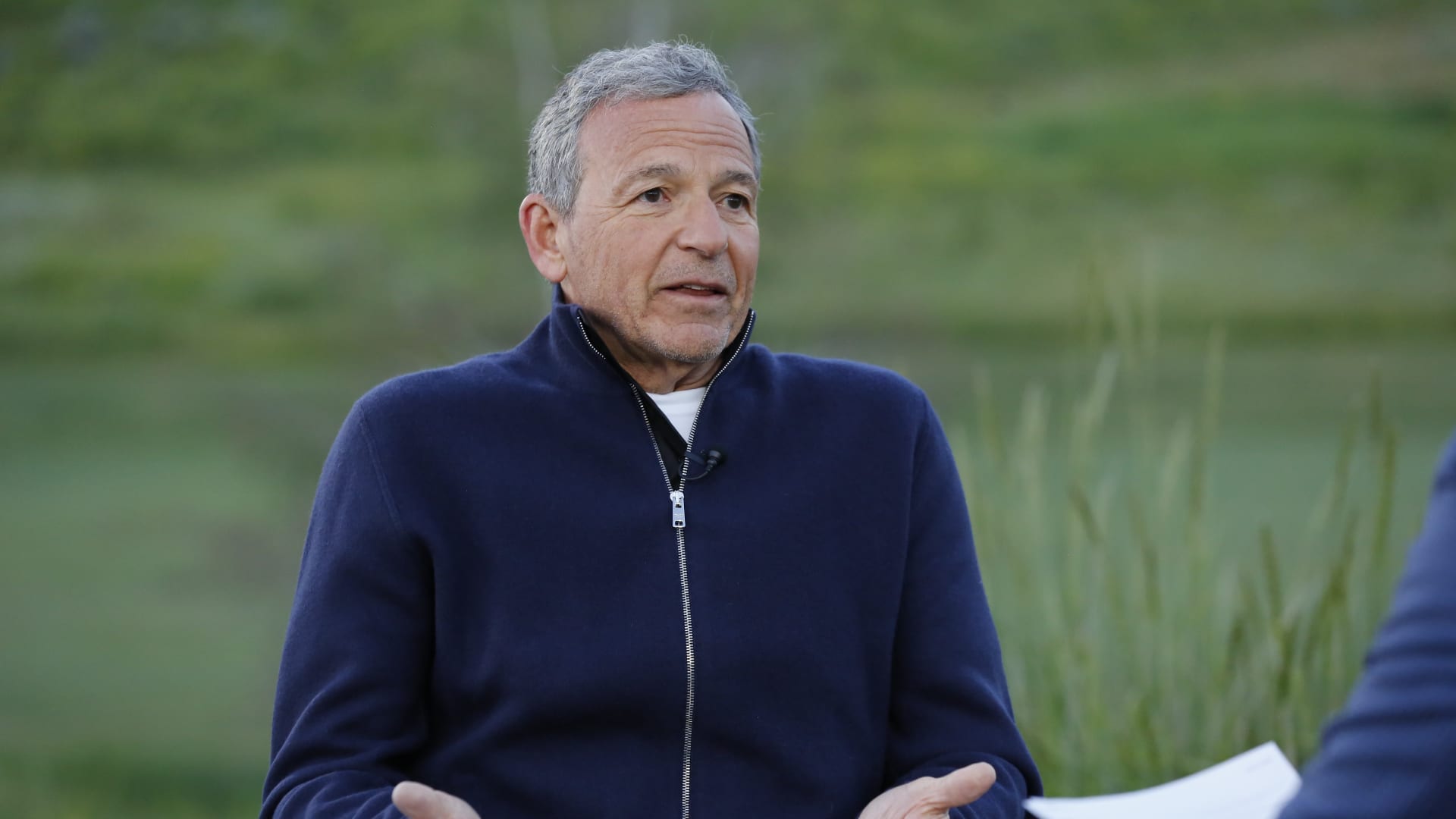

Bob Iger's mind changed means the pressure for quick sale of Star has reduced. That means they may not go for sacrifices in valuation. In earlier situation Reliance can negotiate more and get a majority share. Now the chances are less and Disney seems now seeks for a minority partner or demands un challengable stake value. But becoming a stake holder in 2 major rivals concurrently is complicated for Reliance. Reliance likes to have a controlling stake inorder to merge assets. So I doubt the fate of proposed deal of Disney Star with Reliance. It may get dropped due to Iger's diversion in India strategy.