- Joined

- 16 May 2011

- Messages

- 21,066

- Reaction score

- 30,271

When India opened its broadcast sector to greater foreign investment last fall, the move was hailed by Indian media companies and analysts as a key step in boosting the industry. But only one major deal has happened in the sector since: Goldman Sachs Group Inc.'s GS -2.09% acquisition of a stake in a cable-TV distribution company.

The lack of foreign investment highlights the challenges India’s fragmented broadcast and cable industry face in attracting overseas capital, even as the country of 1.3 billion people offers strong growth potential with just 720 million television viewers.

Many foreign investors aren’t eager to invest in small companies that don’t have a nationwide reach, and India’s broadcast sector is dominated by unprofitable companies that serve specific geographical regions.

“If you’re looking at [investing] $200 million to $500 million, the businesses haven’t reached that scale,” said Ronnie Screwvala, managing director of Walt Disney Co.’s India unit, UTV Software Communications Ltd.

In September, India allowed foreigners to own up to 74% of companies that uplink communication to satellites, or provide cable television or direct-to-home television broadcast services, up from 49% previously. It has long allowed foreign investors to fully own content providers and companies that operate entertainment channels, although foreign ownership of news channels and radio stations remains capped at 26%.

Despite this relaxation on foreign investment, there hasn’t been a rush of foreign capital.

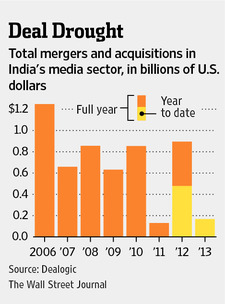

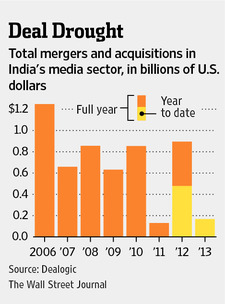

From January to May, Indian media companies received $168 million in investments, a fraction of the $478 million a year earlier, according to Dealogic data.

“The potential was much larger, but clearly…[investments] have been much lower than expected,” said Rambhushan Kanumuri, head of mergers and acquisitions at Barclays Capital in India.

The largest deal in India’s broadcast sector this year was in early May, when Goldman Sachs invested $110 million in Den Networks Ltd. 533137.BY +0.12%, a nationwide cable distribution company with headquarters in New Delhi.

“We believe the cable industry in India…[has] the potential to be significantly larger over the medium to long term,” Goldman spokesman Christopher Jun said.

Screwvala said many media companies in India aren’t attractive investment targets because their owners are focused on growing revenue rather than being profitable.

India’s large cable service providers, which rely on local cable-TV operators to distribute their channels into homes, have been struggling to expand a business that suffers from underreporting of television viewers.

Small cable operators, which provide the majority of cable services in India, usually understate the number of subscribers, media analysts said, which means television service providers in India are unable to derive revenue from all their consumers. Small cable operators declare only 15% to 20% of their TV subscribers, according to a 2012 report by KPMG and the Federation of Indian Chambers of Commerce and Industry, an Indian trade body. That means they pay less money than they should to the big cable companies.

To combat underreporting of subscribers, India said in late 2011 that all TV viewers must switch to digital signals, which can be monitored more accurately, from analog cable signals by December 2014. Digital signals accounted for around 39% of the 153 million households as of Dec 2012, according to TAM Media Research in Mumbai.

Direct-to-home television providers, whose customers receive their television service via satellite dishes, aren’t any more attractive as an investment target. They have to subsidize the cost of set-top boxes to attract customers, and the cost of acquiring new users usually exceeds revenue in the first several years because they need to pay broadcasters to carry their channels.

Tata Sky Ltd., a joint venture between British Sky Broadcasting Group PLC BSY.LN -0.27% and India’s Tata Group that was formed in 2004, is the only major direct-to-home TV provider in India that has a foreign investor.

The company aimed to raise around $466 million from an initial public offering, according to a person familiar with the discussions in January. The share sale has yet to take place, and executives at Tata Sky declined to comment.

Investment bankers say foreign funding could rise after digital signals become the dominant medium of television transmission in India, because that would help boost revenue for broadcasters and large cable companies.

“While it is early days of digitization now, deal activity is likely to pick up” once cable businesses report substantial revenue, said Jagat Dave, managing director at Mumbai-based investment bank Ambit Corporate Finance.

India TV Providers Fail to Woo Foreigners - MoneyBeat - WSJ

.

The lack of foreign investment highlights the challenges India’s fragmented broadcast and cable industry face in attracting overseas capital, even as the country of 1.3 billion people offers strong growth potential with just 720 million television viewers.

Many foreign investors aren’t eager to invest in small companies that don’t have a nationwide reach, and India’s broadcast sector is dominated by unprofitable companies that serve specific geographical regions.

“If you’re looking at [investing] $200 million to $500 million, the businesses haven’t reached that scale,” said Ronnie Screwvala, managing director of Walt Disney Co.’s India unit, UTV Software Communications Ltd.

In September, India allowed foreigners to own up to 74% of companies that uplink communication to satellites, or provide cable television or direct-to-home television broadcast services, up from 49% previously. It has long allowed foreign investors to fully own content providers and companies that operate entertainment channels, although foreign ownership of news channels and radio stations remains capped at 26%.

Despite this relaxation on foreign investment, there hasn’t been a rush of foreign capital.

From January to May, Indian media companies received $168 million in investments, a fraction of the $478 million a year earlier, according to Dealogic data.

“The potential was much larger, but clearly…[investments] have been much lower than expected,” said Rambhushan Kanumuri, head of mergers and acquisitions at Barclays Capital in India.

The largest deal in India’s broadcast sector this year was in early May, when Goldman Sachs invested $110 million in Den Networks Ltd. 533137.BY +0.12%, a nationwide cable distribution company with headquarters in New Delhi.

“We believe the cable industry in India…[has] the potential to be significantly larger over the medium to long term,” Goldman spokesman Christopher Jun said.

Screwvala said many media companies in India aren’t attractive investment targets because their owners are focused on growing revenue rather than being profitable.

India’s large cable service providers, which rely on local cable-TV operators to distribute their channels into homes, have been struggling to expand a business that suffers from underreporting of television viewers.

Small cable operators, which provide the majority of cable services in India, usually understate the number of subscribers, media analysts said, which means television service providers in India are unable to derive revenue from all their consumers. Small cable operators declare only 15% to 20% of their TV subscribers, according to a 2012 report by KPMG and the Federation of Indian Chambers of Commerce and Industry, an Indian trade body. That means they pay less money than they should to the big cable companies.

To combat underreporting of subscribers, India said in late 2011 that all TV viewers must switch to digital signals, which can be monitored more accurately, from analog cable signals by December 2014. Digital signals accounted for around 39% of the 153 million households as of Dec 2012, according to TAM Media Research in Mumbai.

Direct-to-home television providers, whose customers receive their television service via satellite dishes, aren’t any more attractive as an investment target. They have to subsidize the cost of set-top boxes to attract customers, and the cost of acquiring new users usually exceeds revenue in the first several years because they need to pay broadcasters to carry their channels.

Tata Sky Ltd., a joint venture between British Sky Broadcasting Group PLC BSY.LN -0.27% and India’s Tata Group that was formed in 2004, is the only major direct-to-home TV provider in India that has a foreign investor.

The company aimed to raise around $466 million from an initial public offering, according to a person familiar with the discussions in January. The share sale has yet to take place, and executives at Tata Sky declined to comment.

Investment bankers say foreign funding could rise after digital signals become the dominant medium of television transmission in India, because that would help boost revenue for broadcasters and large cable companies.

“While it is early days of digitization now, deal activity is likely to pick up” once cable businesses report substantial revenue, said Jagat Dave, managing director at Mumbai-based investment bank Ambit Corporate Finance.

India TV Providers Fail to Woo Foreigners - MoneyBeat - WSJ

.