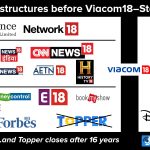

This is a time for heavy shakeups and consolidation in the Indian media industry. After our piece on how the Zee–Sony merger will disrupt Indian media and society, we now turn to the contrasting fortunes of Disney Star and Viacom18/Reliance. Not only are Zee and Sony — giants on their own, but perennial underdogs compared to Disney Star’s dominance — joining forces, but there are signs that the good times may soon be over for Disney Star, and that there may be a new ruler in town: the Mukesh Ambani-led conglomerate Reliance Industries, through its Viacom18 media network — with a small stake held by Paramount Global, previously called ViacomCBS, hence the Viacom name — and JioCinema streaming service after its merger with Voot, with that brand being retired altogether. Disney Star, the country’s largest broadcaster, has been under immense pressure after losing some of its biggest sports properties to Reliance, and its American parent has been thinking of finding a local partner for it, if not selling off a part of the Indian business altogether. Ironically, one of the possible suitors is Reliance itself.

Reliance has never shied away from spending billions of dollars on lucrative media properties, including the digital rights of the Indian Premier League (IPL) and most recently the BCCI cricket and domestic ISL football rights, plus the Paris Olympics in 2024, in order to fuel the growth of JioCinema and its new Sports18 channels which were launched in 2022. JioCinema has grown exponentially from a second-tier platform for Jio telecom customers to what intends to be the country’s biggest streaming service, and it has completely replaced Voot, Viacom18’s existing OTT platform. It has rapidly amped up on content across genres — from movies to series to sports — and provided them for free alongside a premium subscription for its Western properties, despite its name being highly movie-centric in nature. (There were rumours that JioCinema might change its name to JioVoot, but this has not yet happened, and may not happen either.)

Reliance has become especially aggressive on sporting and streaming rights

The Ambanis’ Reliance, whose immense wealth and trigger-happy nature is well known among Indian business circles, disrupted the Indian telecom sector in 2016 with the arrival of Jio, which tremendously slashed data prices and brought tens of crores of Indians online — and on high-speed 4G — faster than ever. This meant incumbents like Airtel and Vodafone Idea (now called Vi) had to either perform or perish, and were forced to innovate with their plans and offerings, including heavily slashing prices. Now Reliance is attempting to recreate the same dominance through sports rights, despite the fact that it has just three Sports18 channels including one HD channel — though two SD channels will be launched in November — and that it is forced to use other channels (including those from other broadcasters) to show its ever-expanding sports properties. Its ambitions are great indeed, having poached many top executives from Disney Star, including ex-CEO Uday Shankar (who sits on Viacom18’s board as part of his and James Murdoch’s Bodhi Tree Investments) and other major decision-makers like Kevin Vaz, the former president and head of Star’s entertainment channels, who has become the new CEO of Viacom18.

However, Viacom18’s TV channels — which mostly use the Colors brand, in addition to several niche brands like MTV, Vh1 and Nick — have a long history of overpromising and underperforming (with only the main Colors channel in Hindi and to an extent Colors Kannada having a large viewership) except in niche genres like English GECs and music/youth where Viacom18 faces little to no competition at all. In contrast, Disney Star has been the top dog for the longest time: two of its GECs, Star Plus (Hindi) and Star Maa (Telugu), are permanently in the top five TV channels in the country as per the BARC ratings. Other regional channels like Asianet (Malayalam), Star Jalsha (Bengali) and Star Pravah (Marathi) — the last of which has established itself in the BARC nationwide top 10, where no non-Hindi, non-South channel was present before — have also maintained their number-one positions by large margins. Meanwhile, Star Sports has so far remained absolutely dominant for over a decade, powered by the holy trinity of IPL, ICC and BCCI cricket rights among several other sports.

And yet if there were ever a time for Disney Star to appear weak, it is now. Its Disney+ Hotstar platform has faced a massive exodus — to the tune of tens of millions of subscribers — in the face of losing the IPL digital rights to JioCinema, even though Star Sports retains their satellite rights, on top of which Viacom18 has snatched both the BCCI cricket and the ISL football rights from Star across satellite and digital. JioCinema has also grabbed many Western series and movies from Disney+ Hotstar, including many HBO originals — like Game of Thrones and Succession — and other properties from Warner Bros. Discovery, which streams them on the Max platform in the United States. (Until May, Max was known as HBO Max in the US, and this name is still used in many other countries.) Known for providing most content for free, like MX Player and unlike other Indian OTT platforms, JioCinema has introduced a paid subscription for such American content, much like the erstwhile Disney+ Hotstar Premium. This has greatly driven down the subscriber numbers of Disney+ Hotstar.

So much so that Disney executives in California have considered selling off the Indian Disney Star business, and the situation has become so dire that, after the big BCCI and ISL deals in September, there were talks with several firms to sell the streaming business and some other assets — including none other than Reliance itself. In October, Disney also entered talks with the Adani group, which now controls NDTV, and South India’s Sun TV Network — and even Sony Group Corporation in Japan, which might consider a deal with Star should Sony’s merger with Zee not take shape. Disney can no longer afford to maintain the losses from its TV channels worldwide, and it has constantly downed the shutters on many TV channels in other parts of the world, including Southeast Asia. Even though Disney Star itself has been successful, Disney has been trying to exit the television business globally, including potentially selling off its ABC and ESPN networks in the US.

The Disney+ streaming service’s average revenue per user (ARPU) for India is the lowest globally, and decisions like making the ongoing ICC Cricket World Cup free to stream — in response to JioCinema’s free IPL streaming — could severely affect Disney+ Hotstar’s revenue. It could be at a major disadvantage against not only JioCinema but also Netflix and Amazon Prime Video with their clutch of Indian originals in Hindi, English and multiple regional languages, as well as SonyLIV, Zee5, MX Player and other well-entrenched streaming services with an expanding subscriber base.

Could Disney Star’s biggest challenger end up being its saviour against the combined Zee–Sony powerhouse, in particular in terms of streaming services, but also linear TV? We explore the strengths and weaknesses of both Disney Star and Reliance/Viacom18 over the next few pages.

No replies yet

Loading new replies...

Join the full discussion at the DreamDTH Forums →