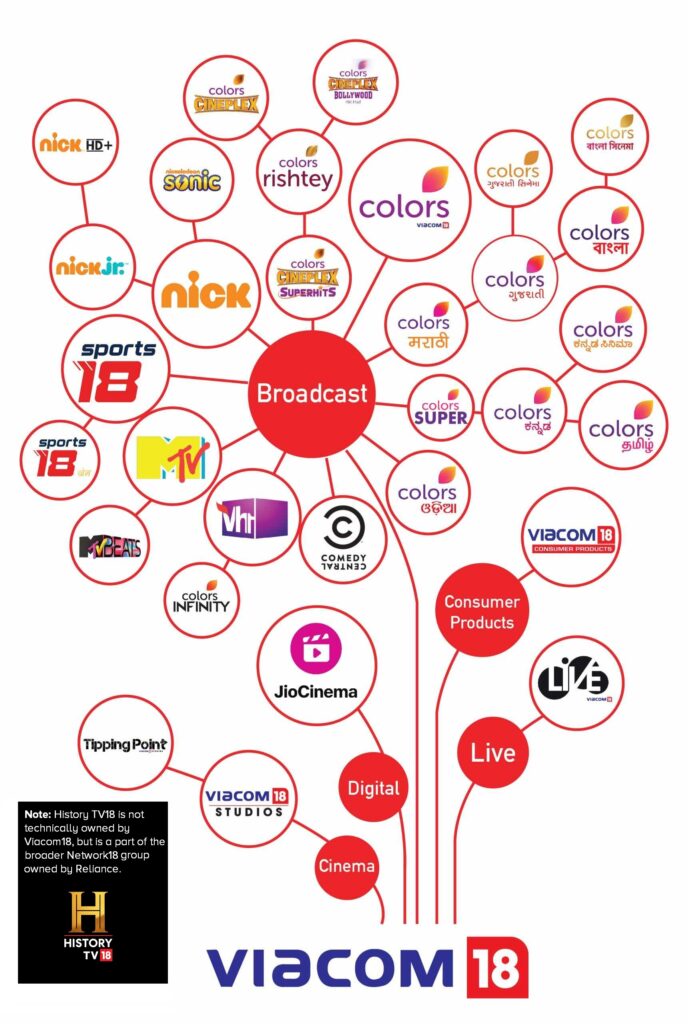

Table of Viacom18 channels (including History TV18)

This table places History TV18 — an infotainment/knowledge channel that celebrated its 12th birthday in October 2023 — under Viacom18, even though technically it is a joint venture between Network18 and A+E Networks, without Paramount Global being involved. Had the lifestyle channel FYI TV18 not shut down in 2020, it would have been treated the same way. It also includes the new sports channels Sports18 2 and 3, which will go on air on 1 November 2023, but neither will have an HD feed for now. Both are listed under the ‘English and multilingual’ language category, though there is the possibility that one of them may be a Hindi-specific channel like Star Sports 1 Hindi and Sony Sports Ten 3.

It does not, however, take into account the numerous news channels (numbering over 20) of the Network18 group — which use the News18, CNBC and CNN brands — in order to make it a fair comparison with Disney Star and Sony, which being foreign-owned do not have any news channels. Some of Network18’s most important news channels are News18 India and CNBC Awaaz (Hindi) and CNN-News18 and CNBC-TV18 (English), of which only the last has an HD feed: CNBC-TV18 Prime HD. Under its Greycells18 division, it also operates Topper TV, an educational channel for schoolkids as summarised in our guide on kids’ and educational channels.

| Language, Genre | GEC | Movies | Sports | Music/Youth | Kids | Infotainment | Total |

|---|---|---|---|---|---|---|---|

| Hindi | Colors (HD), Colors Rishtey | Colors Cineplex (HD), Colors Cineplex Bollywood, Colors Cineplex Superhits | Sports18 Khel | MTV (HD), MTV Beats (HD) | 12 | ||

| English and Multilingual | Colors Infinity (HD), Comedy Central (HD) | Sports18 1 (HD), Sports18 2, Sports18 3 | Vh1 (HD) | Nickelodeon (HD), Nickelodeon Sonic, Nick Jr. | History TV18 (HD) | 16 | |

| Tamil | Colors Tamil (HD) | 2 | |||||

| Kannada | Colors Kannada (HD), Colors Super | Colors Kannada Cinema | 4 | ||||

| Bengali | Colors Bangla (HD) | Colors Bangla Cinema | 3 | ||||

| Marathi | Colors Marathi (HD) | 2 | |||||

| Gujarati | Colors Gujarati | Colors Gujarati Cinema | 2 | ||||

| Odia | Colors Odia | 1 | |||||

| Total | 18 | 7 | 5 | 6 | 4 | 2 | 42 |

Which genres does Viacom18 operate in?

Viacom18 operates in most of the same genres as Disney Star and Zee–Sony, but it is particularly dominant in niche genres like English GEC, music/youth and kids, since many other big broadcasters have exited some of those segments. (However, it has never had a presence in the English movies genre.) Noteworthy, though, is the fact that it is the only private broadcaster to operate any non-news channels in Gujarati — as almost all channels in that language are news channels, aside from some devotional channels and the state-owned DD Girnar — and so Colors Gujarati and Colors Gujarati Cinema enjoy a complete monopoly.

But even though it is present in a number of regional languages, it is not a leader in any of them — and it is also absent from two major South Indian languages, Telugu and Malayalam. (The former is because Viacom18 acquired its current slate of regional entertainment channels from the Telugu-language ETV Network in 2014, and the non-Telugu ETV channels adopted the Colors brand in 2015, leaving ETV as an exclusively Telugu-language broadcaster until the ETV Bal Bharat channels were launched in 2021.)

Hindi GEC: Unlike Disney Star and Zee–Sony, Viacom18 has only one Hindi pay GEC: Colors, its overall flagship channel. It was launched on 21 July 2008 — a decade and a half after Star Plus, Zee TV, Sony TV were launched in the 1990s — and became the only Hindi GEC to be successful among the several that were launched in the late 2000s. Others all shut shop within a few years, like Imagine TV, a joint venture between NDTV and Turner India (now part of Warner Bros. Discovery) before the former exited the joint venture; 9X, which was originally part of 9X Media — now a music-only broadcaster — before it was sold to Zee and later closed; and Zee Next, which barely lasted a couple of years before its closure.

Colors does not have any supporting pay GEC like Star Bharat, Sony Sab and &TV are for Star Plus, Zee TV and Sony TV, respectively. Viacom18’s only other Hindi GEC is Colors Rishtey — launched as Rishtey in 2013 and renamed in 2019 — which airs reruns of Colors shows and was once available on DD Free Dish, before being removed thereafter along with Star Utsav, Zee Anmol and Sony Pal.

Colors’ claim to fame in its early years was its innovative, earthy serials with strong female protagonists, including well-known names like Balika Vadhu, Uttaran and Laado. Over the years, however, it became most associated with the celebrity reality show Bigg Boss and the fantasy series Naagin, which have become as synonymous with Colors as Taarak Mehta Ka Ooltah Chashmah is with Sony Sab, or Yeh Rishta Kya Kehlata Hai with Star Plus. So much so that the Bigg Boss universe has expanded to include Bigg Boss OTT, which enjoys a huge fan following, originally on Voot, which merged into JioCinema. Localised versions of Bigg Boss also air on Colors Marathi and Colors Kannada, with Disney Star’s Star Vijay, Star Maa and Asianet having the Tamil, Telugu and Malayalam adaptations — but Bengali, the remaining ‘Big Six’ regional language, has not managed to sustain the popular reality show.

Other reality shows on Colors include Fear Factor: Khatron Ke Khiladi, which is also quite popular, and formerly Rising Star, a localisation of the eponymous Israeli singing show; India’s Got Talent, which moved to Sony Entertainment Television in 2022; and Jhalak Dikhhla Jaa, the Indian version of Strictly Come Dancing and Dancing with the Stars, which has now returned to Sony TV for the first time since 2011.

Hindi movies: Viacom18 was a late entrant to the Hindi movie channel genre: its flagship Hindi movie channel Colors Cineplex (originally Rishtey Cineplex) was launched in May 2016, nearly two decades after Zee Cinema, Sony Max and Star Gold, on air since 1995, 1999 and 2000 respectively. Its HD version, initially called just Cineplex HD, was launched in February 2017 alongside MTV HD+ (now MTV HD) and renamed to Colors Cineplex HD in 2019, to coincide with the SD version’s removal from DD Free Dish.

However, the Rishtey Cineplex name was briefly revived in 2020 in the form of a new channel for DDFD viewers, which was renamed to Colors Cineplex Superhits in April 2022 and is expectedly focused on South action movies. Meanwhile, a fourth channel, Colors Cineplex Bollywood, was launched in April 2021 — exactly a year before Colors Cineplex Superhits — and focuses on less massy, more artistic movies from all eras and genres, much like Sony Max 2, Zee Bollywood or Star Gold Romance. Interestingly, and oddly for a non-South-actioner-focused channel, it is also present on DDFD.

As far as its Hindi movie library is concerned, Viacom18 does not have too many flashy blockbusters, but it does have a handful of strong content partnerships, most notably with Karan Johar’s Dharma Productions. Most of the seven films directed by Johar, including the latest Rocky Aur Rani Kii Prem Kahaani, have their satellite rights belonging to Colors Cineplex, as are most Dharma movies in general, from Shershaah to Gehraiyaan to Govinda Naam Mera — some recent exceptions being Brahmastra – Part One: Shiva, Liger and Selfiee which are with Star Gold.

In addition, it has its in-house Viacom18 Studios and Jio Studios, which have given it Laal Singh Chaddha, Bhediya, Zara Hatke Zara Bachke and the upcoming Dunki, plus titles like Andhadhun (2018) and Queen (2013) from the past decade — though co-productions with Maddock Studios like Stree (2018) and Mimi (2021) are with Star instead. Furthermore, several blockbusters from Red Chillies Entertainment, such as Om Shanti Om (2007) and Chennai Express (2013), now belong to Colors Cineplex after spending many years airing on other channels like Zee Cinema — though recent Red Chillies movies like Darlings and Jawan are with Zee. There are deals with other producers as well, such as movies directed by Sanjay Leela Bhansali, three of which — Goliyon Ki Raasleela Ram-Leela (2013), Bajirao Mastani (2015) and Padmaavat (2018) — are with Viacom18, but Gangubai Kathiawadi (2022) is with Zee Cinema.

Sports: Much has been made of the multi-billion-dollar deals that Reliance signed to bag the digital rights of the Indian Premier League in June 2022, and the global BCCI cricket rights across all platforms in August 2023. Other cricket properties are also growing steadily, including the SA20 cricket league, whose first season aired in January 2023, and the South African cricket rights starting from 2024 which were previously with Star. But the broadcaster also caters to several other sports, most notably football and above all the 2022 FIFA World Cup, which truly brought Sports18 and JioCinema into the spotlight as a force to reckon with in Indian sports broadcasting.

In the months leading up to the launch of the Sports18 channels in April 2022, Viacom18 bagged several football properties like LaLiga, Ligue 1 and Serie A — which, as previously mentioned, aired on MTV and Vh1 — followed by the 2022 FIFA World Cup, its first sporting event to stream for free on JioCinema. These have now been augmented by the addition of the Indian Super League or ISL, which has moved from Star Sports as it enters its tenth year. In December 2022, Viacom18 also acquired the broadcast rights to the Paris Olympics and Paralympics in 2024, breaking Sony’s stronghold over four-yearly multi-sport events like the recent Asian Games in Hangzhou and the Tokyo Olympics in 2021.

However, as much as Reliance is betting heavily on JioCinema to disrupt sports media consumption in the country, it is neglecting the distribution of its Sports18 channels. Effectively only one SD and one HD channel are present on major TV platforms, since Sports18 Khel, its Hindi channel, is more or less confined to DD Free Dish and Dish TV NSS6/SES8 — which is also the case for the recent launch of DD Sports HD. Even though Sports18 2 and 3 are launching on 1 November, they will not be available in HD for the time being, and to have only one full-time HD sports channel is practically laughable where Star Sports has seven of them and Sony five. It seems that Viacom18 will continue to take the support of its movie and youth channels (occasionally also third-party channels) for airing sports in the near future, until Sports18 reaches the scale that Sony Sports Network — which also grew from a single channel, Sony Six — has.

Regional channels: Most of Viacom18’s regional channels have actually been around since the late 1990s and early 2000s, using the ETV brand until the Hyderabad-based ETV Network sold them to Reliance in 2014. Consequently, they adopted the Colors brand in 2015: hence Colors Kannada, Marathi, Bangla, Gujarati and Odia, the first three of which launched HD versions in 2016. (Also, channels like ETV Rajasthan and ETV Urdu switched to the News18 brand by 2018. So did some ETV News-branded channels launched in the 2010s like ETV News Kannada and Bangla — in fact, these were always owned by Network18, never ETV!) Network18 has therefore so far been prevented from operating Telugu channels thanks to an agreement with ETV, but this may change in the future.

As a result, ETV returned to focus solely on Telugu channels, which remained the case until it launched as many as 14 ETV Bal Bharat children’s channels in April 2021, in a whopping 12 languages including Telugu, though many have since been closed. Meanwhile Viacom18 continued to launch new regional channels, including the secondary Kannada GEC Colors Super in 2016, and movie channels in Kannada, Bengali and Gujarati in 2018–19. In February 2018, it also entered a new market with the launch of Colors Tamil, including in HD, but it is nowhere as successful as other new regional GECs launched in the late 2010s like Zee Keralam, Sony Marathi and Sun Bangla. (Interestingly, Colors Super and Colors Kannada/Bangla/Gujarati Cinema place their logos in the top left corner of the screen — very rarely seen outside the Zee network — as against most other Network18 channels, which use the typical top right corner, standard among most Indian channels, except Vh1 and the CNBC-branded channels which use the bottom right.)

Indeed, in general, Colors’ regional channels have by and large struggled in the ratings chart, with Colors Bangla barely registering at all — given the near-duopoly of Star Jalsha and Zee Bangla — and Colors Tamil and Odia never making the cut to the top 5 channels. (The latter market is also, strangely, an anomaly for Disney Star, as its one-year-old Star Kiran has failed to make an impact thus far.) Colors Kannada, which used to rule the Kannada market with outside support from Colors Super and Colors Kannada Cinema, has lost its lead to Zee Kannada, with Star Suvarna trailing behind.

Colors Marathi is an also-ran as well, with the pole position belonging to Zee Marathi for years until Star Pravah stormed to the top in 2020: Zee Marathi — despite multiple Marathi sister channels — is now a shell of its former self. The sole exception is Gujarati, where Colors Gujarati and Colors Gujarati Cinema are completely unchallenged, with not a single other broadcaster having a presence: almost all Gujarati channels are news channels, with other genres like music completely absent, which is extremely unusual.

English GEC: Viacom18 is arguably the only Indian broadcaster to have truly mastered the English GEC genre, thanks to having not one but two successful channels: Comedy Central, which was launched in 2012, and Colors Infinity, which went on air in 2015. Given the closure of Sony’s AXN in June 2020 and the Star World channels in March 2023, the content strategy of these channels has been an unexpected success — with Zee Café being the only competition — at a time when the great majority of urban English-speaking Indians get their fix of Western shows from Netflix, Amazon Prime Video, Disney+ Hotstar and the like, as well as Reliance’s own JioCinema and the erstwhile Voot Select. Thanks to evergreen sitcoms like Friends, The Big Bang Theory and Young Sheldon, which make great value for repeat binge-watching, Comedy Central has stamped itself into urban Indian pop culture. Colors Infinity, on the other hand, has a selection of American series and reality shows plus some Indian non-fiction shows. Much like Vh1 among English music channels, they have held their own in a shrinking market. (However, as mentioned, Viacom18 is completely absent from the English movie genre, with the Times Network and its group of Now-branded channels going head-to-head with Disney Star and Zee–Sony.)

Niche genres: Viacom18 has had a longstanding presence in the kids’, music/youth and infotainment genres, using non-Colors brands like Nick, MTV and Vh1, as outlined below.

- Kids’ channels: Viacom18’s children’s channels are concentrated under the Nickeoldeon (Nick) brand, with the master Nick channel being launched back in 1999, and others in the 2010s: Nickelodeon Sonic in 2011, Nick Jr. in 2012 — which shared bandwidth with TeenNick until 2017 when Nick Jr. became the sole surviving channel — and Nick HD+ in 2015, the first HD kids’ channel in India, with Cartoon Network and Disney Channel launching HD feeds in 2018 and 2023 respectively. Some of their most famous properties include Motu Patlu and Pakdam Pakdai among Indian animation shows and Ninja Hattori among Japanese cartoons, though Nick HD+ focuses more on Western shows than the others.

- Music and youth: This, like the English GEC genre, is an area where Viacom18 has prospered at the expense of other broadcasters. It operates three strong channels in this segment: MTV (Hindi youth, with some music shows), MTV Beats (Hindi popular music) and Vh1 (English music) — the last of which is the only one left in its genre after the exits of 9XO and Nat Geo Music. What’s more, all three of these channels are available in HD, with the only other Indian HD music channels in any language being the Sun network’s Sun Music HD and Gemini Music HD. Other HD music channels like Sony Rox HD and MTunes HD have ceased broadcasting, and the likes of 9XM, Zoom, Mastiii and B4U Music — despite being on air for almost two decades — have never considered HD feeds.

- Lifestyle and infotainment: At present, History TV18 is the only channel that comprises the AETN18 joint venture between Reliance-owned Network18 and A+E Networks; Paramount Global (formerly known as ViacomCBS) is not involved. It was launched on 9 October 2011 (including in HD, which had only just begun to make inroads into Indian TV) and celebrated its 12th anniversary recently. More than just a reincarnation of The History Channel from Star — which lasted from 2003 to 2008, evolving over the years into the modern-day Fox Life — it has held fort as one of a handful of knowledge/infotainment channels in India, alongside Discovery, Nat Geo, Animal Planet and Sony BBC Earth. There also used to be a popular lifestyle channel from AETN18: FYI TV18, which went on air in 2016 and quickly beat Fox Life, TLC, Travelxp and others to the top of its genre, but was abruptly axed on its fourth birthday in July 2020 due to mounting losses.

Conclusion

All these developments at Disney Star and Reliance/Viacom18 are tectonic shifts in the Indian media industry, and, along with the long-pending Zee–Sony merger, will permanently disrupt how Indians consume their entertainment across a plethora of platforms. Disney Star is desperately trying to hold on to its leadership position, all while Disney is trying to exit non-core businesses like TV globally, while Reliance is going all-in on JioCinema to shoulder its less-than-ideal TV business and transform how content, especially sports, is streamed in the same way that Jio revolutionised the telecom sector. Smaller players like the Sun network (whose dominance is confined to the Tamil market) and Enterr10 and Goldmines (whose free-to-air Hindi channels have profited tremendously from DD Free Dish) will no doubt have to adapt to stay relevant in the coming decades. When all is said and done, the late 2010s and early 2020s will remain one of the most transformative periods in the Indian media industry.

These analyses done, we will return to various genres of channels: with all national channels covered in previous articles, we next turn to South Indian channels (Tamil, Telugu, Kannada, Malayalam) — easily the biggest and most important group of regional channels in terms of viewership and market share — followed by East (Bengali, Odia, Assamese, Bhojpuri) and West & North (Marathi, Gujarati, Punjabi, Urdu) channels thereafter.

No replies yet

Loading new replies...

Join the full discussion at the DreamDTH Forums →