In the April-June quarter of 2023, the four major direct-to-home (DTH) service providers in India, namely Tata Play, Dish TV, Airtel Digital TV, and Sun Direct, collectively gained 250,000 new subscribers. This surge marks a positive reversal from the previous quarter’s decline, as reported by the Telecom Regulatory Authority of India (TRAI).

Overview of Pay DTH Subscriber Base

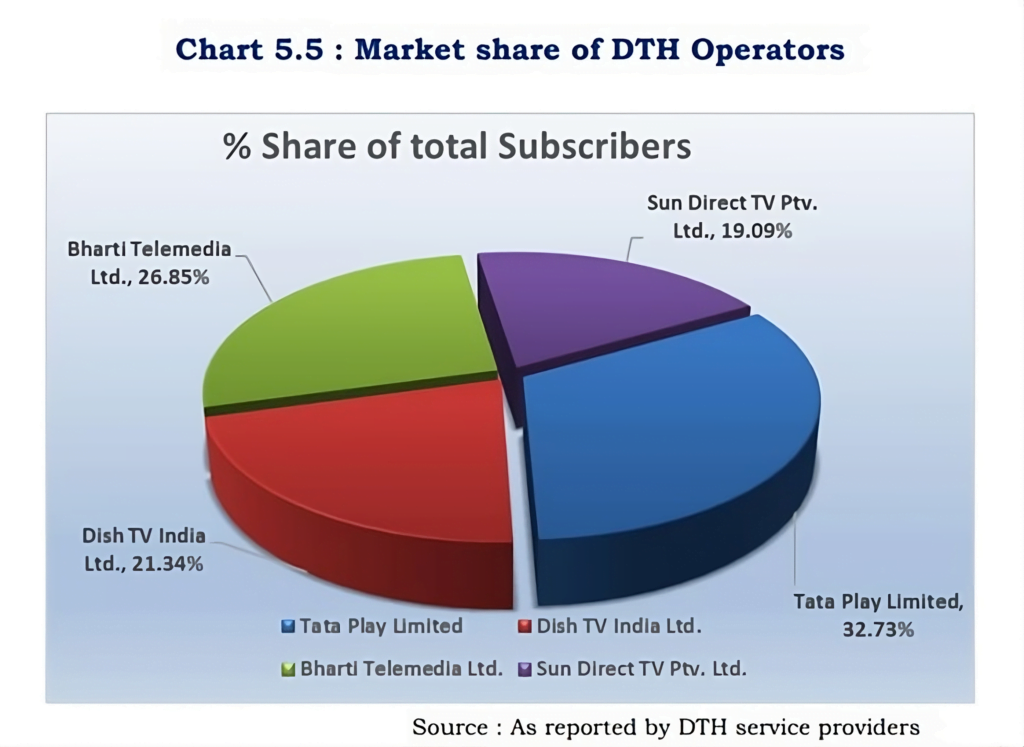

The TRAI’s performance indicator report reveals that the active subscriber base for these four pay DTH operators increased by 0.38% quarter-on-quarter, reaching a total of 65.50 million subscribers. However, on a year-on-year basis, there was a 2.29% decrease compared to the 67.04 million subscribers in the same quarter a year ago. Notably, the previous quarter had seen a decline of 1.37 million subscribers.

Breaking down the numbers, Tata Play led with 21.43 million subscribers, followed by Airtel Digital TV with 17.58 million, Dish TV 13.97 million, and Sun Direct 12.5 million as of June 2023.

Multi-System Operators (MSOs) and Digital Cable TV Services

In addition to the pay DTH operators, twelve multi-system operators (MSOs) and one headend in the sky (HITS) operator holding over a million subscribers increased, with a collective base of 43.9 million subscribers. However, the number of MSOs with permission to provide digital cable TV services slightly declined from 1,748 to 1,737.

Channels Pricing and Landscape

While the number of permitted TV channels remained at 903, the count of pay channels increased from 358 to 360 in the June quarter. Among these, 256 are standard definition (SD), and 104 are high definition (HD). Interestingly, 58 SD pay TV channels are priced under Re 1, with additional channels falling within the Rs 1 to Rs 5, Rs 5-12, and Rs 19 categories.

TRAI’s data indicates that among the 360 pay TV channels, 114 are general entertainment channels, 71 are movie channels, and 62 are news and current affairs channels.

Radio Landscape

On the radio front, the report highlighted the stability of private FM radio channels, with 388 operational channels in 113 cities operated by 36 private FM radio operators. The cumulative ad revenue for these channels during the quarter stood at Rs 390 crore, reflecting a marginal increase from the previous quarter.

6 replies

Loading new replies...

Join the full discussion at the DreamDTH Forums →