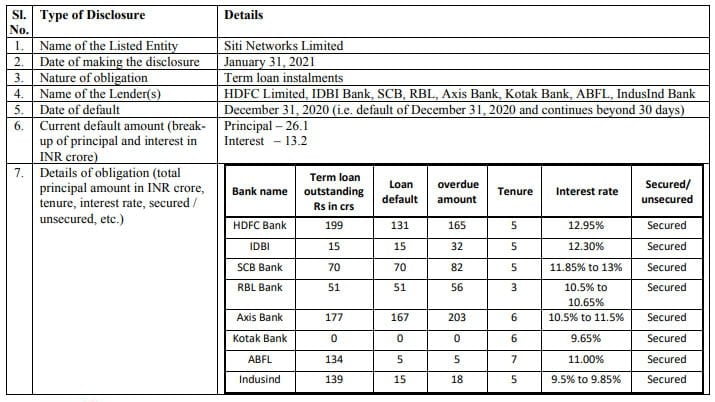

Essel Group-owned Multi-System Operator (MSO) Siti Networks has around Rs 914 crore outstanding borrowings from banks and financial institutions at January 2021 end according to a regulatory filing by the company today. The obligation is term loan installments. HDFC Bank, IDBI Bank, SCB, RBL, Axis Bank, Kotak Bank, ABFL, and IndusInd Bank are among the lenders whom Siti owns loan overdue amount.

All the term loans are secured from respective banks. Siti has a Rs 199 crore term loan outstanding from HDFC Bank at 12.95 percent interest rate with Rs 131 crore loan default and Rs 165 crore over due amount in a 5 year long loan.

Siti has a Rs 15 crore term loan outstanding from IDBI at 12.3 percent interest rate with Rs 15 crore loan default and Rs 32 crore over due amount in a 5 year long loan. Siti has a Rs 70 crore term loan from SCB at 11.85 to 13 percent interest rate with Rs 70 crore loan default and Rs 82 crore over due amount in a 5 year long loan.

Siti has a Rs 51 crore term loan outstanding from RBL Bank at 10.5 to 11.5 percent interest rate with Rs 51 crore loan default and Rs 56 crore overdue amount in a 3-year long loan. Siti has a Rs 177 crore term loan outstanding at 10.5 percent to 11.5 percent interest rate with Rs 167 crore loan default and Rs 203 crore overdue amount in a 6 year long loan.

Siti Networks has repaid the 6 year-long loans from Kotak Bank. The company has a Rs 134 crore term loan outstanding from ABFL at an 11 percent interest rate with Rs 5 crore loan default and Rs 5 crore overdue amount in a 7 year-long loan.

Siti Networks lastly has a Rs 139 crore term loan outstanding from IndusInd at a 9.5 percent to 9.85 percent with Rs 15 crore loan default and Rs 18 crore overdue amount in a 5-year long loan.