In the first two months of 2024, the fate of the Indian media industry for the foreseeable future was all but sealed, thanks to the collapse of one mega-merger in the making and the confirmation of another. After discussions for over two years, Japanese electronics and media conglomerate Sony Group Corporation eventually terminated the long-proposed merger of its Indian unit, Culver Max Entertainment (a.k.a. Sony Pictures Networks India), with Zee Entertainment Enterprises worth US$10 billion on 22 January, over allegations concerning Zee’s founder Subhash Chandra and his son Punit Goenka — Zee’s MD and CEO — regarding fraudulent transactions. This threw both companies’ grand ambitions to conquer the Indian television and media industry into complete disarray, destroying their hopes of challenging the dual behemoths in the form of Disney Star and Reliance-owned Viacom18 with their aggressive broadcast, sports and streaming slates.

Zee and Sony’s worst fears may now have been realised, as those two competitors, which were already powerful in their own right, will now fuse into one giant entity that will make it almost invincible and unassailable. On 28 February, The Walt Disney Company and Mukesh D. Ambani’s Reliance Industries officially announced the merger of their respective Indian broadcasting entities, Disney Star and Viacom18 — including their respective streaming platforms, Disney+ Hotstar and JioCinema. As a result, Viacom18 will be merged into the existing Star India Private Limited entity; Viacom18 — to be renamed Digital18 — will hold the largest stake of 46.82% in the joint venture, and its parent RIL 16.34%, leaving 36.84% for Disney, which will maintain its Indian presence that has lasted for nearly three decades.

Rumours that Disney was trying to broker a deal with Reliance for Star’s future had surfaced in late 2023 — as it was looking at cutting down on non-core businesses like linear TV globally (having shut down countless channels in regions like Southeast Asia) — and those have now been confirmed. Reliance will invest an unprecedented ₹11,500 crore (US$1.4 billion) into the joint venture, whose valuation stands at ₹70,352 crore (US$8.5 billion) — severely affected thanks to the collapse of the Zee–Sony merger, which directly impacted Star’s valuation as Zee would have broadcast some ICC cricket matches (whose rights are otherwise with Star) were that merger to succeed.

Nita M. Ambani, Mukesh Ambani’s wife, will be the chairperson of the merged entity — a logical decision since she is an eminent businesswoman in her own right, including owning the Mumbai Indians men’s and women’s cricket franchises as well as the Reliance Foundation, a charity. Former Star CEO Uday Shankar — who left the company and founded an independent firm, Bodhi Tree Systems, along with former 21st Century Fox CEO James Murdoch, who then announced over a billion dollars worth of investments in Viacom18 — will become its vice-chairperson, marking a return to his original home.

Also, an important point to note is the fact that Paramount Global — which was an original stakeholder in Viacom18, contributing to the now-retired Viacom name — has completely exited the venture and handed over full control of Viacom18 to Reliance. (However, Paramount+ content remains available to stream via JioCinema.) As such, the Viacom18 brand will soon cease to exist, bringing an end to the Viacom name worldwide, and the plan is for it to be renamed Digital18 in preparation for its merger with Disney Star.

Reliance and Disney’s union will lead to an indomitable, unstoppable Goliath

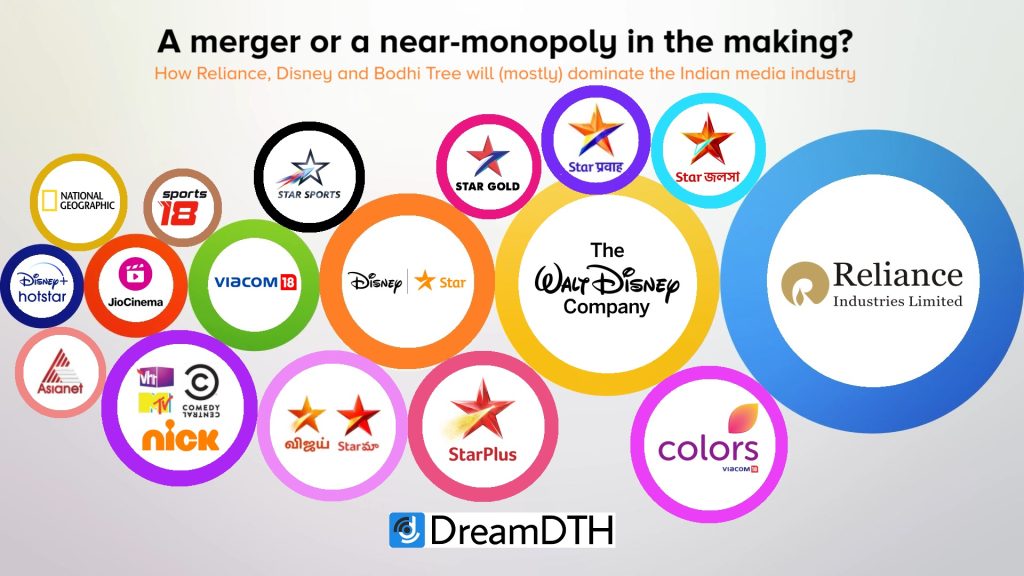

This mega-deal ensures that Disney will continue to have a presence in India, five years after it acquired Star from the erstwhile 21st Century Fox in 2019, while leaving the day-to-day operations and decision-making to the Ambanis, perhaps India’s best-known billionaire conglomerate family. Star, known as Disney Star since 2022, has always been India’s largest broadcaster in terms of number of channels and viewership, thanks in large part to its flagship Hindi channel, Star Plus, the Star Sports network and numerous regional channels. Moreover, its Disney+ Hotstar streaming platform has always been at the forefront of the Indian OTT industry, with more subscribers than Netflix, Amazon Prime Video, SonyLIV, etc. combined — though this has taken a severe hit thanks to JioCinema’s acquisition of multiple digital properties, particularly the IPL and BCCI cricket rights.

Meanwhile, Reliance, with its acquisition of Network18 in 2014 — originally founded in the 1990s by journalist couple Raghav Bahl and Ritu Kapur — cemented itself as one of the foremost names in the Indian media business. Network18 consists of the Viacom18 entertainment business* (the Viacom name coming from what is today Paramount Global, previously ViacomCBS) and what later became the News18 channels, which are run separately, alongside other divisions. Most of Viacom18’s channels use the Colors brand, but many other niche brands — including Comedy Central, Nick, MTV and Vh1 — are also quite popular. In the 2020s it has also spearheaded the growth of the JioCinema streaming service, replacing the erstwhile Voot, with mostly free content — above all the IPL’s digital rights — and some paid Western content from HBO and other leading studios.

What will happen when India’s biggest broadcaster, Star, joins forces with India’s largest business empire, Reliance? Many ex-Star executives who left for Viacom18 — particularly Kevin Vaz, a Star veteran who is presently Viacom18’s CEO — will return to their original home. The multi-billion-dollar rights of the Indian Premier League, which are now split between Star for broadcast and Reliance (JioCinema) for digital, will once again come under one umbrella. Disney has managed to find a crucial Indian partner as it reduces its focus on linear broadcast globally, and it could not have asked for a bigger or more powerful one than Reliance. Most importantly, the combined entity will have so much muscle power — from the Ambanis, from Disney, from Bodhi Tree and others — that it will be simply too huge for Zee, Sony, Sun and others to compete with it.

Challenges to the merger from antitrust bodies — swiftly overcome

Naturally, with so many genres in common and a combined market share of more than 40% — the threshold set by the Competition Commission of India (CCI) to determine dominance — in multiple regional languages, the merger between Star and Viacom18 was bound to face heavy scrutiny from multiple quarters. In several genres, particularly sports, the combined dominance of both broadcasters will be so massive that neither Zee nor Sony (whose own merger was scrapped) nor Warner Bros. Discovery, Sun, ETV or any other broadcaster will be able to pose any sort of significant competition to this goliath. Therefore, it is a given that some existing Star and Viacom18 channels need to be sold or shuttered for the merger to be completed, which they hope to be done by October.

In mid-August 2024, it emerged that in order to gain approval for the merger from the CCI, the broadcasters agreed to shut down some of their channels in the Kannada, Marathi and Bengali languages where their combined market share would be too great. Both Star Pravah (Marathi) and Star Jalsha (Bengali) are the leaders of their languages, while Colors Kannada ruled the Kannada market for years and is one of Viacom18’s very few successful regional GECs — though Star Suvarna (Kannada), Colors Bangla and Colors Marathi have been less popular. Only time will tell which exact channels are eventually axed in each case.

Further, Tamil and Odia (where both broadcasters are present) may also be scrutinised — though perhaps not Telugu and Malayalam, where only Star is present, or Gujarati, where Viacom18 has a monopoly. Moreover, the broadcasters propose to get rid of secondary Hindi GECs, keeping only the flagship Star Plus and Colors, and do away with smaller Hindi movie channels. However, they are not in favour of giving up their existing lucrative sports rights — with cricket rights like IPL being the biggest of all — or closing any sports channels unless circumstances dictate otherwise. Additionally, the plan is to keep only JioCinema — which has grown exponentially over the past few years — as the combined broadcaster’s streaming platform and discard the bigger, established Disney+ Hotstar.

Eventually, on 28 August 2024 — exactly six months to the day after the merger was announced, and on the same day (Wednesday) of the week — the CCI finally gave its approval for the merger after both broadcasters offered numerous concessions to allow it to go through. Why this giga-merger will turn out to be such a missed opportunity for Zee and Sony, which had themselves harboured hopes of dominating Indian media and OTT that now lie shattered, is what we will explore over the next couple of pages.

*The infotainment/knowledge channel History TV18 is under a separate joint venture, AETN18, outside the purview of Viacom18, as was the now-defunct lifestyle channel FYI TV18. It may or may not be brought under the control of the merged entity after the deal is completed.

643 replies

Loading new replies...

Join the full discussion at the DreamDTH Forums →