New Delhi- India Ratings & Research Private Limited (India Ratings), a Fitch group company, has assigned the credit rating of “IND A1+” to TV18 Broadcast Limited’s (TV18) commercial paper of up to Rs.750 crore.

TV18 Broadcast Limited yesterday writing to the BSE to disclose the ratings under the regulations informed the stock exchange about the rating and enclosed the rating letter issued by India Ratings requesting it to kindly take the above information on record.

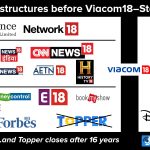

TV18 being key to the Network18 Group was a key rating driver. TV18 operates across news, entertainment and infotainment genres contributing to about 97% of Network 18’s consolidated revenue in FY19. TV18 is also strategically important to RIL. It is in the core of RIL strategy to increase its share of consumer business.

TV18 is operationally important to RIL’s digital business from customer-acquisition and customer-retention aspect. Although RIL has not provided any explicit support to Network18 Group but Ind-Ra derives comfort from RILs implicit support, exemplified by its large ownership in Network18 Group.

TV18 also has a strong business profile. TV18 derives about 70% of its revenue from advertising, which remains linked to economic cyclicality. Positive subscription growth and increased penetration of direct-to-home and digital cable systems led to growth in end-subscriber pricing and improved content offerings, bolstering TV18’s place as a key content player in the value chain.

TV18 also has a healthy financial profile supported by stable margins and revenue growth. TV18 has healthy profitability and adequate cash flows to support its debt obligations, despite working capital intensive nature of the business.

The weakening of TV18’s linkages with Network18 Group, weakening of Network18 Group’s linkages with RIL, including a reduction in Network18’s strategic importance to RIL and weakening of the credit profile of RIL or RJio is the rating sensitivities.