- Joined

- 3 Nov 2010

- Messages

- 31,514

- Solutions

- 3

- Reaction score

- 52,742

New Delhi: The DTH, cable and teleport sectors are set to attract foreign investments worth $1 billion (R5,500 crore) in the next six months following the hike in the FDI cap to 74%. International operators and investors, including Ecostar, Globecast, Singtel, RR Sat, Direct TV, Astro, Ashmore and Comcast, are expected to forge strategic alliance with companies present in the teleport, direct-to-home and digital cable sectors.

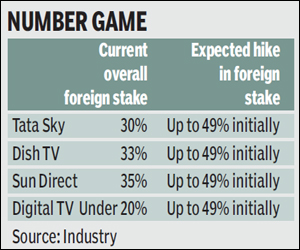

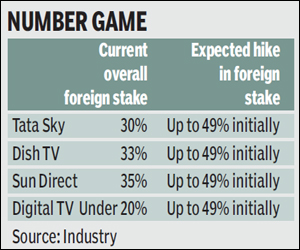

Experts believe foreign control in DTH firms such as Tata Sky, Sun Direct, Dish TV, Videocon d2H, Airtel digital TV and Reliance Big TV will go up “very soon”, followed by cable companies like Hathway, DEN, InCable and others.

“Relaxing the FDI cap from 49% to 74% in broadcast carriage services is a big step, though it is much delayed. Now, a host of foreign players will engage the Indian operators in next few months. This will help step up the process of digitisation where investments are required to be made by the cable industry,” said Smita Jha, leader, entertainment and media, PwC India.

Echoing the sentiments, Devendra Parulekar, partner, Ernst & Young, said: “A lot of action is expected in the coming few months as foreign players have been waiting on the sidelines for this policy change."

Experts said the initial FDI in the broadcast sector could come in five out of six private DTH operators. “Tata Sky and Airtel Digital are already in talks with their foreign partners. Even Videocon D2H has been scouting for overseas investors. There are also talks between Dish TV with its US-based allies in the satellite TV business. All these talks can convert into foreign investments soon,” said an analyst who tracks media companies.

Based on the last closing price (September 14) on the BSE, the combined market cap of the listed entities in DTH and cable space was around R15,000 crore. “If foreign investors take the last price and decide to buy an average of 20% in these companies, the sector can easily get R3,000 crore in FDI. Add that to FDI in unlisted firms and you can easily get $1 billion for an average of 20% stake, leaving enough head room for further FDI,” the analyst said.

However, Dish TV managing director Jawahar Goel offered a different take. “High entertainment taxation by the state governments, coupled with service tax and a high licence fee, have made foreign investors wary about returns. Increasing FDI cap to 74% in the broadcasting services is not the solution. Rationalising the tax and licence regime is the key,” he said.

Asked why the government is not doing so, Goel said: “The biggest roadblock is the reluctance on part of the I&B ministry to reach a solution. Sadly, we do not have an access to PMO to get the work done like some of my counterparts in telecom, DTH and cable companies.”

But experts said DTH companies is where the first big-ticket foreign investments will flow. “On annual investments of R5,000 crore, the DTH industry posts a combined annual loss of R2,000 crore. Players need funds to keep up the growth momentum as the subscriber numbers are increasing by the day. News Corp is surely expected to hike its stake in Tata Sky and so will Malaysian-based Astro,” said another analyst.

Source

Experts believe foreign control in DTH firms such as Tata Sky, Sun Direct, Dish TV, Videocon d2H, Airtel digital TV and Reliance Big TV will go up “very soon”, followed by cable companies like Hathway, DEN, InCable and others.

“Relaxing the FDI cap from 49% to 74% in broadcast carriage services is a big step, though it is much delayed. Now, a host of foreign players will engage the Indian operators in next few months. This will help step up the process of digitisation where investments are required to be made by the cable industry,” said Smita Jha, leader, entertainment and media, PwC India.

Echoing the sentiments, Devendra Parulekar, partner, Ernst & Young, said: “A lot of action is expected in the coming few months as foreign players have been waiting on the sidelines for this policy change."

Experts said the initial FDI in the broadcast sector could come in five out of six private DTH operators. “Tata Sky and Airtel Digital are already in talks with their foreign partners. Even Videocon D2H has been scouting for overseas investors. There are also talks between Dish TV with its US-based allies in the satellite TV business. All these talks can convert into foreign investments soon,” said an analyst who tracks media companies.

Based on the last closing price (September 14) on the BSE, the combined market cap of the listed entities in DTH and cable space was around R15,000 crore. “If foreign investors take the last price and decide to buy an average of 20% in these companies, the sector can easily get R3,000 crore in FDI. Add that to FDI in unlisted firms and you can easily get $1 billion for an average of 20% stake, leaving enough head room for further FDI,” the analyst said.

However, Dish TV managing director Jawahar Goel offered a different take. “High entertainment taxation by the state governments, coupled with service tax and a high licence fee, have made foreign investors wary about returns. Increasing FDI cap to 74% in the broadcasting services is not the solution. Rationalising the tax and licence regime is the key,” he said.

Asked why the government is not doing so, Goel said: “The biggest roadblock is the reluctance on part of the I&B ministry to reach a solution. Sadly, we do not have an access to PMO to get the work done like some of my counterparts in telecom, DTH and cable companies.”

But experts said DTH companies is where the first big-ticket foreign investments will flow. “On annual investments of R5,000 crore, the DTH industry posts a combined annual loss of R2,000 crore. Players need funds to keep up the growth momentum as the subscriber numbers are increasing by the day. News Corp is surely expected to hike its stake in Tata Sky and so will Malaysian-based Astro,” said another analyst.

Source