Reliance, Viacom18 and JioCinema: Will it dethrone Star as the king of Indian media?

Viacom18’s paradox: massive investments, meagre ratings and offerings

For all the financial might of the Ambanis — and their domination in the telecom sector through Jio that led to lakhs of lost subscribers for the desperately struggling Vodafone Idea, or Vi — we should be well aware of Reliance’s immensurate, bottomless spending capabilities, and its hunger to conquer all areas it ventures into. Viacom18’s multi-crore investments in sports properties like the BCCI, ISL and WPL (broadcast and digital) and the IPL (only digital) have sent shockwaves throughout the Indian media industry. Equally, putting most of its content for free on JioCinema, with only Western content such as HBO originals requiring a subscription, has dramatically shot up its ad-driven revenue and simultaneously brought down the subscriber base of Disney+ Hotstar. That it has poached big executives from Disney Star, including Uday Shankar, Alok Jain and Kevin Vaz — the new CEO of Viacom18 — who were responsible for Star’s domination of the Indian TV industry, speaks to just how ambitious and powerful the Reliance-backed company is.

And yet, ironically, Viacom18 has never been a leader the way Disney Star has been, neither does it possess the depth and breadth of the combined Zee–Sony entity. Sure, it has a presence in multiple genres and languages, but it has only managed to be an also-ran in most of them, barring niche genres like English GEC and music/youth with barely any competition to speak of. Viacom18 seems to be overly dependent on Colors, its flagship Hindi GEC, and in particular for the reality show Bigg Boss and the fantasy drama series Naagin, which at least help it to get a consistent top-10 position in the national BARC ratings that typically eludes Zee TV and Sony TV. Colors Kannada — once the network’s only leading regional GEC — has lost its crown to Zee Kannada, in a rare market that is not controlled by Star. But its other Colors-branded channels are by no means successful if ratings are used as a metric.

Focusing on JioCinema over Sports18: Too many sports properties, too few channels

Sports18 is an even stranger contradiction: on the one hand Viacom18 is set to be the ultimate home of Indian cricket, with its big-ticket acquisition of the global BCCI rights and the women’s WPL, plus the digital rights of the IPL whose satellite rights continue to be with Star Sports — not to mention the Paris Olympics in 2024. However, this only serves to hide a startling truth: there are just three Sports18 channels currently on air, one of which is a Hindi channel — Sports18 Khel — confined to DD Free Dish (and Dish TV’s SES8/NSS6 viewers), compared to the whopping 17 channels from the Star Sports network, of which seven are HD channels and five are regional channels. Due to its hesitancy in launching new sports channels, Viacom18 has been forced to show many of its smaller sports events on movie channels like Colors Cineplex and Colors Kannada Cinema. With so much content, Sports18 1 (SD and HD) and Khel are simply too little to work with. Fortunately Sports18 2 and 3 will be launched on 1 November, but these will not be available in HD yet.

In mid-2021, when the Sports18 channels did not yet exist, Viacom18 acquired the rights to three major European football leagues (LaLiga, Ligue 1 and Serie A) and was forced to show them on its music/youth channels like MTV and Vh1. A year later, it broadcast the 2022 FIFA World Cup in Qatar on just two Sports18 channels — aside from MTV HD, which has a very limited outreach — with the great majority of its focus being the free streaming on JioCinema, with multiple languages and a 4K feed. Now that it has the Indian Super League football rights, it has been showing matches on not only the Sports18 channels and some of its movie channels but even third-party channels in the football-crazy markets of Kerala and West Bengal: the Sun network’s Surya Movies in the former — in addition to Reliance’s Malayalam news channel, News18 Kerala — and the state-owned DD Bangla from Doordarshan in the latter, despite having Colors Bangla Cinema there.

Such strange decisions are unimaginable for other broadcasters but seem to be the norm here, and unless more full-time Sports18 channels are launched to cater to the ballooning demand for sports broadcast, it will be difficult for linear TV viewers — not all of whom can readily access JioCinema at high 4G/5G speeds — to regard Viacom18 as a serious sports broadcaster like Star and Sony.

What about the name of JioCinema?

All the focus is on JioCinema as an all-in-one TV replacement, since Voot has now ceased to exist. It is becoming increasingly unlikely that JioCinema will change its name, given the heavy marketing and promotion it received for the FIFA World Cup, IPL and other major events. It is very strange indeed that despite the movie-centric nature of the name, Reliance has refused to drop the JioCinema brand and replace it with something more all-encompassing, catering to all tastes from entertainment to movies to sports to kids — as Voot clearly did. JioVoot was thrown around at some point, but it did not come to pass, despite some app leaks clearly stating the JioVoot name.

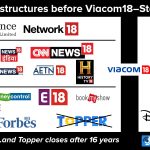

Should JioCinema consider changing its name to become more holistic, some options include either keeping the Jio part of the name and changing the Cinema part — something like Jio’s main telecom competitor Airtel does with Airtel Xstream — or introducing the Colors brand to streaming, in order to better represent Viacom18’s main entertainment brand that signifies a wide range of content to watch. In fact, the Viacom18 name itself is out of tune with the global renaming of ViacomCBS to Paramount, and excluding History TV18 from the entity is a rather strange approach to take. A unified branding approach covering the television, telecom and streaming verticals of Reliance may be a better solution instead of differentiating between various names, with the parent company of the entertainment business (including History TV18) using one brand — possibly Jio or Colors — and applying the same for the streaming service, and the news channels under the sibling Network18 group (including CNBC- and CNN-branded channels) continuing with the News18 or TV18 brands.

On the next page, we tabulate the Viacom18 channels, including History TV18, the way we have done for Disney Star — but note that this excludes the News18 channels, including several that use the CNN or CNBC brands, which would have boosted the total from 42 (after the launch of Sports18 2 and 3) to almost 70 channels.

No replies yet

Loading new replies...

Join the full discussion at the DreamDTH Forums →