Regional languages

This is where the stark difference between Star and Viacom18 is the most apparent. The former has a number of successful regional channels, most of which are the leaders in their genres — Star Maa (Telugu) in particular is among the top 5 nationally — in addition to supplementary movie (and, occasionally, music) channels. On the other hand, Viacom18’s Colors-branded regional channels have barely tasted such success and remain bottom-feeders in the ratings chart — with the possible exception of Colors Kannada, which ruled television in Kannada for years. With the merger, it is more than likely that some of these regional channels, especially from Viacom18’s side, may be axed altogether.

No fewer than four out of Disney Star’s seven main regional GECs are the leaders of their languages. Star Maa (Telugu) and Star Pravah (Marathi) are in the BARC national top 10, too far ahead of the next-best, while Star Jalsha (Bengali) and Asianet (Malayalam) also lead their respective languages but by smaller margins. Moreover, Star Vijay (Tamil) — even though a long distance behind Sun TV, the perennial ruler of Tamil TV — has also secured a place in the national top 10. The two outliers are Star Suvarna (Kannada), which has always played catch-up with Zee Kannada and Colors Kannada though it remains ahead of the Sun network’s Udaya TV, and the more recent Star Kiran (Odia), which has thus far been a total disaster in the two years of its existence while Zee Sarthak and the locally owned Tarang dominate that market.

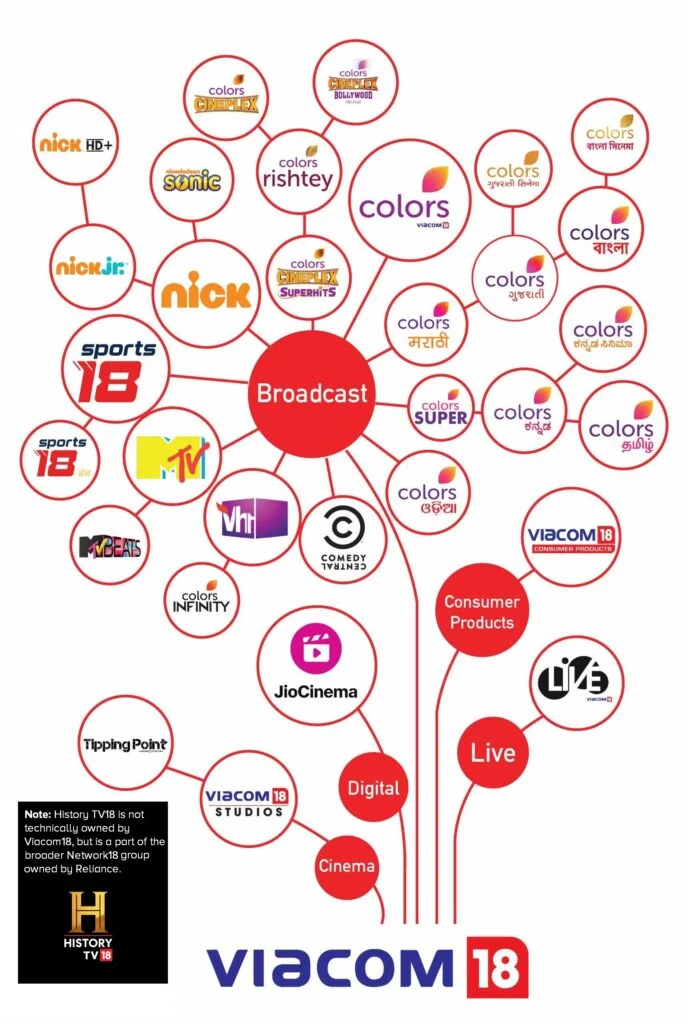

In contrast, almost all of Viacom18’s regional channels have been failures, be it Colors Marathi, Colors Bangla or Colors Odia — which were acquired from Telugu broadcaster ETV in 2014 and rebranded in 2015 — or Colors Tamil, which was launched in 2018. There are only two moderate success stories: Colors Kannada and its sibling Colors Super, which together were the most popular Kannada channels until being overtaken by Zee Kannada; and Colors Gujarati, which (along with Colors Gujarati Cinema) enjoys a total monopoly, as no other private broadcaster has a Gujarati non-news or non-Hindu devotional channel. All the regional GECs from Star have HD feeds, except Asianet Plus in Malayalam, while from Viacom18 Colors Kannada, Marathi, Bangla and Tamil have them, but not Colors Super, Gujarati or Odia.

Both broadcasters also have a significant number of movie channels: Disney Star has Vijay Super (Tamil), Star Maa Movies and Star Maa Gold (Telugu), Star Suvarna Plus (Kannada), Asianet Movies (Malayalam) — as Asianet Plus is a secondary GEC — Jalsha Movies (Bengali) and Pravah Picture (Marathi), almost all of which have HD feeds except Star Suvarna Plus and Star Maa Gold. Meanwhile, Viacom18 has Colors Kannada Cinema, Colors Bangla Cinema and Colors Gujarati Cinema, which have no HD feeds planned. In addition, Star operates Vijay Takkar, a hybrid youth/movie/rerun channel in Tamil, as well as Star Maa Music — not to mention Star Sports 1 Tamil and Telugu (including HD feeds for both) and Kannada to complete its massive regional slate.

Niche genres

Moreover, there are some niche genres where both broadcasters often use different brands instead of Star and Colors. The kids’ genre sees Disney Star using the Disney Channel and Hungama brands instead of Star, while Viacom18 uses the Nickelodeon or Nick brand, with four channels each (including one in HD) for both broadcasters. In the knowledge or infotainment genre, Disney Star has National Geographic and Nat Geo Wild, and though Viacom18 itself has nothing here, its sister concern AETN18 (a joint venture between Reliance and A+E Networks) operates History TV18. In the travel and lifestyle segment, Disney Star operates Star Life — known as Fox Life for a decade until it finally adopted the Star brand in April 2024, the last Disney-owned channel globally to abandon the Fox brand — while AETN18 operated FYI TV18 from 2016 until its closure in 2020.

Where Viacom18 beats Disney Star, however, is in a couple of highly niche, urban genres in which Disney Star has either sharply reduced its presence or abandoned them entirely. They are English GEC and music/youth, but note that Viacom18 has never had a presence in the English movie genre, where Star Movies and its sibling Star Movies Select are established brands. Among English GECs, Viacom18’s pair of Colors Infinity and Comedy Central have ruled the roost for years, while Disney axed its Star World channels in March 2023, leaving only the teen-oriented Disney International HD in the genre.

In music and youth, too, Viacom18 has three established channels — MTV (Hindi youth drama/reality), MTV Beats (Hindi music) and Vh1 (English music) — whereas Disney Star has only Bindass, and even this might be shuttered in the near future. Of note is the fact that Viacom18 has managed to sustain HD feeds for all three of its music/youth channels — with the Sun network being the only other operator of HD music channels (Sun Music HD and Gemini Music HD) — and other music channels have either shut down (Sony Mix and Sony Rox HD, MTunes HD, Nat Geo Music HD) or never launched HD feeds (9XM, Zoom, Mastiii, etc.). This is a sign that Viacom18 maintains its commitment towards such niche genres even in a streaming-driven era, and these are likely to continue after the merger.

Conclusion

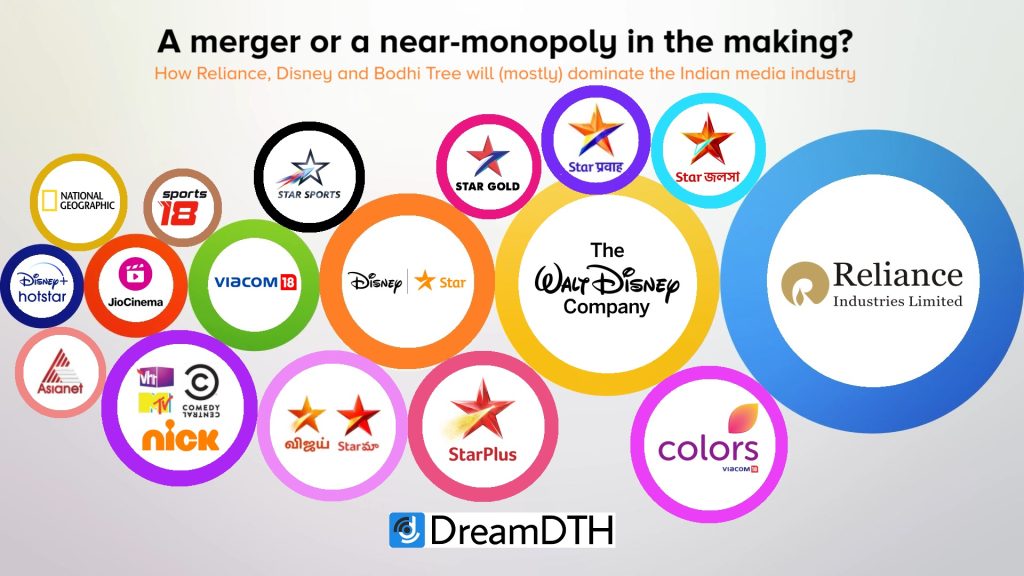

The immensity, the sheer monopolistic nature and the profound implications of the biggest media deal in Indian history cannot be understated. With the biggest obstacle — clearance from the Competition Commission of India — having been cleared at the end of August 2024, there is absolutely nothing in the way of Disney, Reliance and Bodhi Tree Systems creating a humongous behemoth worth many billions of dollars. Equally, the formation of such a tremendous goliath — even though some channels might be sold or closed here and there — spells a grim, especially bleak future for Zee and Sony (whose own merger collapsed at the final hurdle) as well as Sun, ETV, Times Network, Warner Bros. Discovery and other smaller broadcasters, including free-to-air ones like Enterr10 and Goldmines. These smaller players may have to merge and trigger a wave of consolidation to stand any chance of standing and surviving in the era of the Disney Star–Reliance near-monopoly.

643 replies

Loading new replies...

Join the full discussion at the DreamDTH Forums →