How does each genre stack up? Repercussions and rewards

Hindi GECs (General Entertainment Channels)

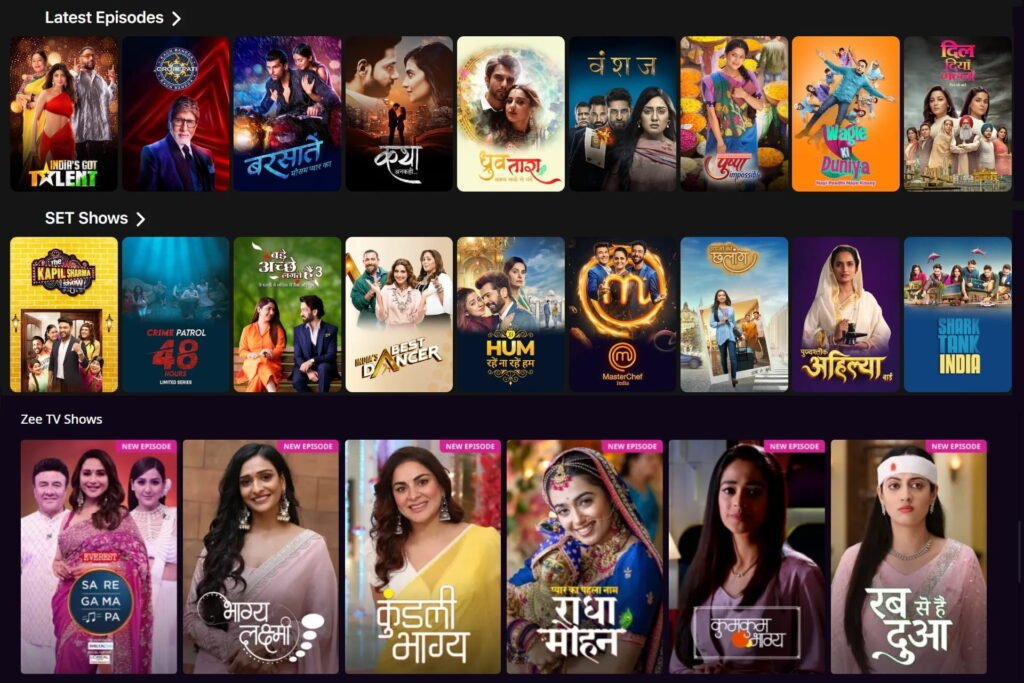

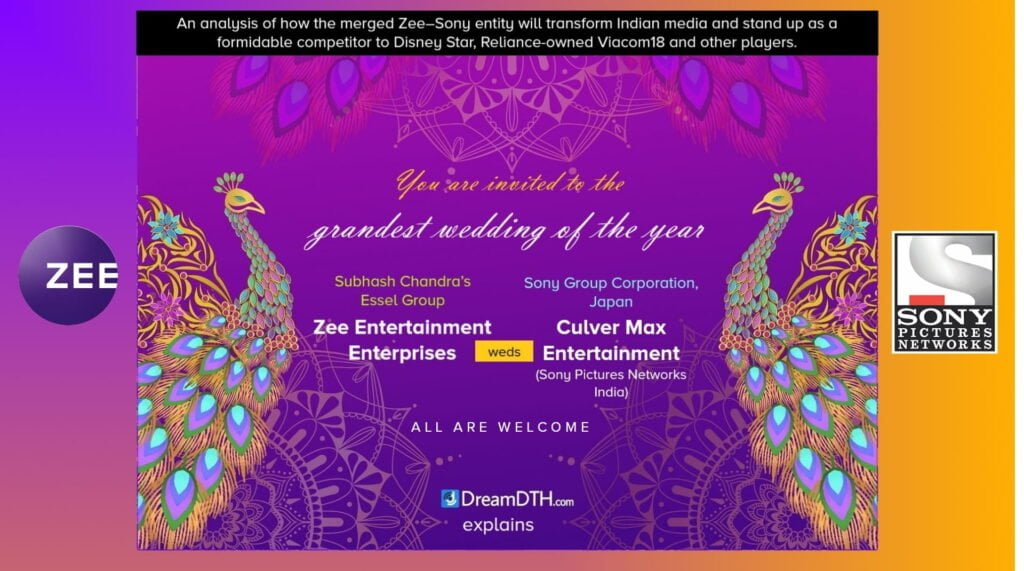

Individually, Zee and Sony have had an immense presence in the Hindi GEC sector, the most important genre in the country by viewership. The combined Zee–Sony entity can boast of three top-line Hindi GECs that have been around for decades: Zee TV was launched back in 1992 and Sony Entertainment Television (better known as SET or Sony TV) in 1995, while Sony Sab was launched as SAB TV by Sri Adhikari Brothers in 1999 and acquired by Sony in 2005. Zee TV focuses on traditional serials (of the saas-bahu kind) and some reality shows, while Sony TV is mostly known for its non-fiction properties — like Shark Tank India, Kaun Banega Crorepati, Indian Idol, MasterChef India (previously on Star Plus) and India’s Got Talent (moved from Colors) — aside from several fiction shows, including many historical and mythological productions. Yet another reality show will soon move to Sony: Jhalak Dikhhla Jaa, which so far aired on Colors but is returning to Sony after 12 years. This means that the great majority of well-known reality shows on Hindi GECs will belong to a single channel, and Colors may be left with only Bigg Boss — even if it doesn’t follow Star Plus’ extreme of abandoning all reality shows in favour of serials.

Meanwhile, Sony Sab has built its reputation on family serials, including the long-running sitcom Taarak Mehta Ka Ooltah Chashmah, which has been on air for 15 years since 2008. Until 2022, it was perceived as a family comedy channel, but after the mega-rebrand of all Sony channels in October 2022 on Diwali, it has shifted firmly away from that image and transformed itself into a ‘living-room brand’, with drama series like Dhruv Tara, Dil Diyaan Gallaan and Vanshaj. In addition, Zee–Sony has a large number of supporting Hindi GECs: the urban-focused &TV, which hasn’t enjoyed much success since its launch in 2015, other than the sitcom Bhabi Ji Ghar Par Hai!; rural-focused rerun GECs Zee Anmol and Sony Pal, which were initially present on DD Free Dish but were removed thereafter; and the free-to-air GEC Big Magic (owned by Zee since 2016) which remains available on DD Free Dish and airs several old Zee TV serials in addition to animation shows.

In terms of viewership, Sony Sab is the only one that regularly appears in BARC’s weekly list of top 10 most popular channels across India, and sometimes Zee TV as well. Neither Zee TV nor Sony TV has the sort of viewership power that competitor Star Plus — a permanent member of the top 5, and very often India’s number one channel — can command for its serials, or that Viacom18’s Colors can generate for shows like Bigg Boss and Naagin. Also, Zee TV has only ever had homegrown reality shows like Sa Re Ga Ma Pa, Dance India Dance and more recently Bzinga, which don’t enjoy the popularity that Indian adaptations of international reality shows (as listed above for Sony TV) do on OTT/social media, if not the ratings chart. But Zee and Sony’s brand recognition is unparallelled, and in fact the SET India YouTube channel is the 4th-most-subscribed YouTube channel in the world at over 160 million subscribers, while Sony Sab and Zee TV are also in the worldwide top 20, with over 85 and 70 million respectively.

Days after the Sony channels’ mega-rebrand in October 2022, Zee and Sony agreed to sell off Big Magic after the merger — along with Hindi movie channels Zee Classic and Zee Action — in order to address concerns from the Competition Commission of India (CCI) over their dominance in the Hindi GEC and movie sectors. Zee acquired Big Magic from Reliance Anil Dhirubhai Ambani Group in 2016 along with the Bhojpuri channel Big Ganga, but while the latter rebranded in September 2021 to Zee Ganga, Big Magic didn’t adopt the Zee brand — and in fact the buyers for these three channels cannot be either Star or Viacom18 as per the clause submitted to the CCI, pointing to an independent future for them. Even without such supplementary channels, the combined power of Sony TV for reality shows (plus many fiction shows) and Zee TV and Sony Sab for their dramas will be a challenge for Star Plus/Star Bharat and Colors to beat — not to mention Dangal, the free-to-air GEC that has consistently enjoyed a top-five nationwide ranking for almost five years now, thanks to DD Free Dish.

Hindi movies

In the Hindi movie genre, both ZEEL and SPN have a long-entrenched presence through brands like Zee Cinema, Sony Max and &pictures, the last of which crossed the one-decade mark on 18 August 2023. But it is Zee that has a far bigger presence among the two, with nine channels (6 SD + 3 HD) — the same number as Disney Star — compared to Sony’s four (3 SD + 1 HD) that is much weaker. Combined, however, SPN will be able to make use of Zee’s strengths in its library and channel segmentation, in order to better take on not only the Star Gold- and Colors Cineplex-branded channels but more importantly Goldmines, which has fixed a position for itself in the BARC top 5 channels thanks to its unrivalled library of South Indian movies — at Sony Max’s expense, since it previously relied heavily on Goldmines Telefilms for its South-driven movie lineup.

Zee has a diverse range of Hindi movie channels for different segments: Zee Cinema, the flagship; &pictures, the urban-focused secondary channel; &xplor HD, a premium HD-only offering for niche or arthouse movies, like Star Gold Select; Zee Bollywood, which shows older or lesser-known movies from all eras; the rural-focused Zee Anmol Cinema, which remains available on DD Free Dish unlike its GEC counterpart Zee Anmol; and finally Zee Classic and Zee Action, which will be sold as mentioned above. Sony, for its part, has the flagship Sony Max, which has slowly started to gravitate back towards Hindi movies after being predominantly South-oriented for nearly a decade; Sony Wah, which like Zee Anmol Cinema (and unlike Sony Pal) is present on DD Free Dish; and Sony Max 2, a classic channel like Zee Classic, though it has recently started to show more recent movies from the 2000s or 2010s.

In terms of movie libraries, SPN and ZEEL have an unmatched selection across Bollywood, South Indian and Hollywood movies. Well-known premieres from 2022 and 2023 include RRR, Gangubai Kathiawadi, Cirkus, Kisi Ka Bhai Kisi Ki Jaan, Bholaa, Mili and Mrs Chatterjee vs Norway — most recently the worldwide blockbuster Jawan starring Shah Rukh Khan — on Zee Cinema/&pictures, and KGF: Chapter 2, Bhool Bhulaiyaa 2, Kantara, Afwaah and Tu Jhoothi Main Makkaar on Sony Max, which together account for more than half of the big recent releases. However, Disney Star still has a huge edge, not least because it has grabbed the rights to many movies of Yash Raj Films (YRF) including all post-2019 releases — most importantly Pathaan, also an SRK-starrer and the year’s biggest blockbuster before Jawan — even though Sony (the original rightsholder of all YRF movies until 2018) still has more than half of the YRF collection in its hands. Zee and Sony have additional agreements with several producers, including Salman Khan Films for Zee and T-Series Films for Sony, and together they will be a formidable competitor to Disney Star, Viacom18 and Goldmines.

Next page: Sports properties; regional channels; English and niche channels

1,496 replies

Loading new replies...

Join the full discussion at the DreamDTH Forums →