The COVID-19 pandemic has disrupted how people consume content on TV and digitally. As more Indians across urban areas and increasingly in rural areas subscribe to Netflix, Amazon Prime Video or Disney+ Hotstar at lower prices than before, and with improving Internet connections, linear TV channels have struggled to stay relevant. This is especially prominent in the Hindi movie channel genre, where Star Gold and Disney’s other Hindi movie channels (hereafter collectively referred to as Disney-Star) have profited at the expense of their competitors.

Two years ago, well before the start of the pandemic, when our article on ‘Fifty shades of differentiation: The evolution of Hindi movie channels’ was published, there were already signs that Sony Max was headed for serious trouble if it did not change course and cut down on showing dubbed South Indian movies. Time has proved its critics right and Sony Max has tumbled from the top of the Hindi movie genre to a lowly position, conceding its top spot to Star Gold. Of course, BARC viewership data for Hindi movie channels are no longer available to the public, but everything points to the rapid rise of Star Gold and Disney’s other Hindi movie channels.

Star Gold is the one Hindi movie channel that does (almost) everything right

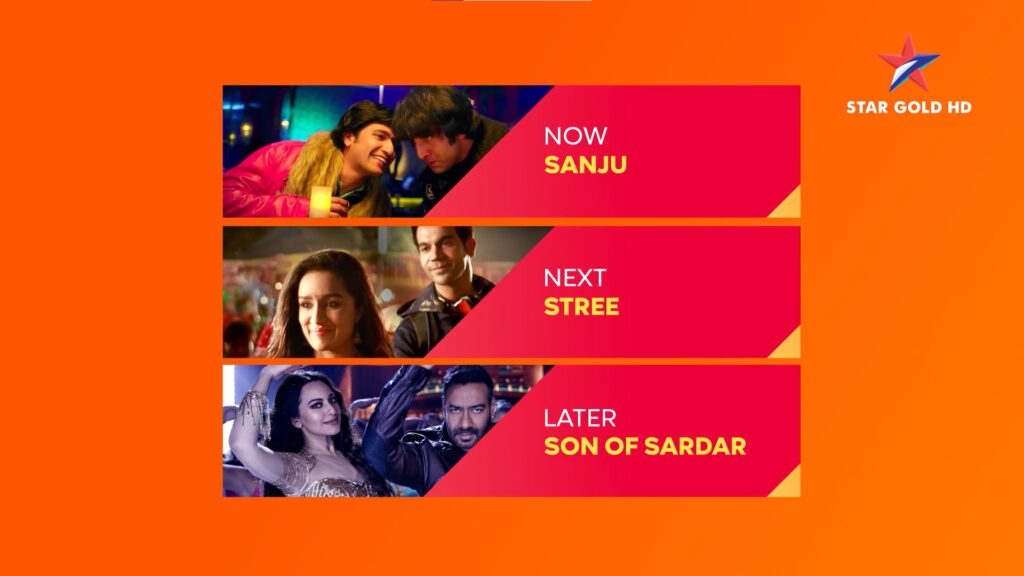

Since Star Gold rebranded with a new look in February 2020 before the pandemic became global, along with Movies OK rebranding to Star Gold 2, it has only become better and better. It has bagged a large number of new Hindi releases, many of which premiered on Disney+ Hotstar first under the so-called Multiplex branding. (It is a different matter that many of these movies, such as Laxmii, Hungama 2 and Sadak 2, were trashed by critics.) Star Gold’s success can be attributed to big-budget premieres such as Tanhaji: The Unsung Warrior, Badhaai Ho, Mission Mangal, Chhichhore and Super 30. It is excellent at showing all sorts of Hindi movies, both recent and old ones, while also giving prominence to South Indian dubbed movies as those remain popular with the masses. It has also taken over the premieres of all new movies from Star Plus, whose last premiere was Dil Bechara in August 2020. Before then, Star Plus used to premiere quite a few movies, but since mid-2020 it has shifted its focus solely on its serials, and has profited tremendously from them to become India’s numero uno Hindi channel.

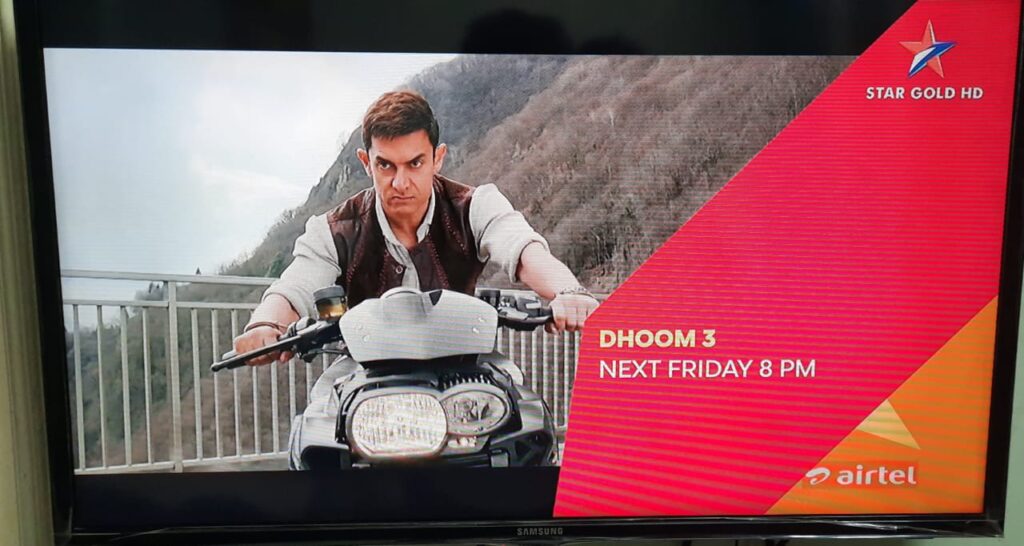

To top it all, Star Gold made waves in July 2021 by grabbing the satellite rights to many Yash Raj Films movies from Sony, such as Dilwale Dulhania Le Jayenge, Dil Toh Pagal Hai and Dhoom: 3, as explained further below. These provide excellent repeat value for its premium sibling Star Gold Select, which already has a sizeable library of offbeat and acclaimed titles, and is present on most TV platforms — unlike &xplor HD, its counterpart from Zee. Star Gold Select may not be premiering new movies like it did when it was launched in 2017, but it remains the home of offbeat and arthouse cinema as well as slightly older titles from the 2000s and early 2010s that are not recent or well-known enough to air on Star Gold.

Many of Disney’s other Hindi movie channels, namely Star Gold 2, UTV Movies and Star Utsav Movies, show a variety of new and old movies without repeating them excessively. Given that Disney does not explicitly have a Hindi movie channel that focuses on classic movies, as Sony Max 2 and Zee Classic clearly do, that job is shared between UTV Movies and Star Utsav Movies — the latter of which is available on DD Free Dish and therefore also shows many South dubbed movies that appeal to the masses.

The name of Disney, of course, is best known for Hollywood movies, and even those get a prominent place on Star Gold in the form of Hindi dubbed versions. Star Gold’s schedule consists of plenty of dubbed Hollywood movies such as Avengers: Endgame, Frozen 2 and Toy Story 4, which come from famous Disney-owned studios such as Marvel and Pixar. Of course, they are also regularly aired on the broadcaster’s English movie channel Star Movies — as well as on two additional Hindi channels, namely UTV HD and UTV Action, which are almost entirely dedicated to Hollywood films dubbed in Hindi, but this is just poor scheduling. Disney-Star also plans to rebrand Star Utsav Movies to Star Gold Family at some point in the future, for which it has obtained permission from MIB. It additionally has a licence for Star Gold Romance and even plans to launch Star Gold 2 HD at some point, but when these changes will actually come into effect is a mystery for the time being.

With so many Hindi movie channels both currently on air and in the pipeline, Disney-Star has a humongous multilingual movie library to match. It has been aggressive in acquiring older movies from other broadcasters and striking new deals with production houses. One well-known partnership has been with Jio Studios and producer Dinesh Vijan’s Maddock Films, whereby all movies produced by them (including many popular titles such as Bala, Luka Chuppi, Stree, Roohi and Mimi) will premiere on Star Gold. The recent deal with YRF gives Disney-Star a slew of new and upcoming releases such as Sandeep Aur Pinky Faraar, Shamshera and the Akshay Kumar-starrer Prithviraj, while War, Disney-Star’s first-ever YRF movie, has consistently been a blockbuster on the ratings chart. It has also been grabbing South Indian movies left and right from other broadcasters, especially those dubbed into Hindi by Goldmines Telefilms, where Sony Max previously had an advantage. Finally, having Walt Disney Studios, Marvel Studios and Pixar Animation Studios in-house gives it access to an enormous Hollywood library. It is no surprise that Disney-Star’s Hindi movie cluster has had everything going in its favour since Star Gold’s rebranding in 2020, and it is showing no signs of slowing down any time soon.

Sony Max went all-in on South dubbed movies, neglecting Bollywood

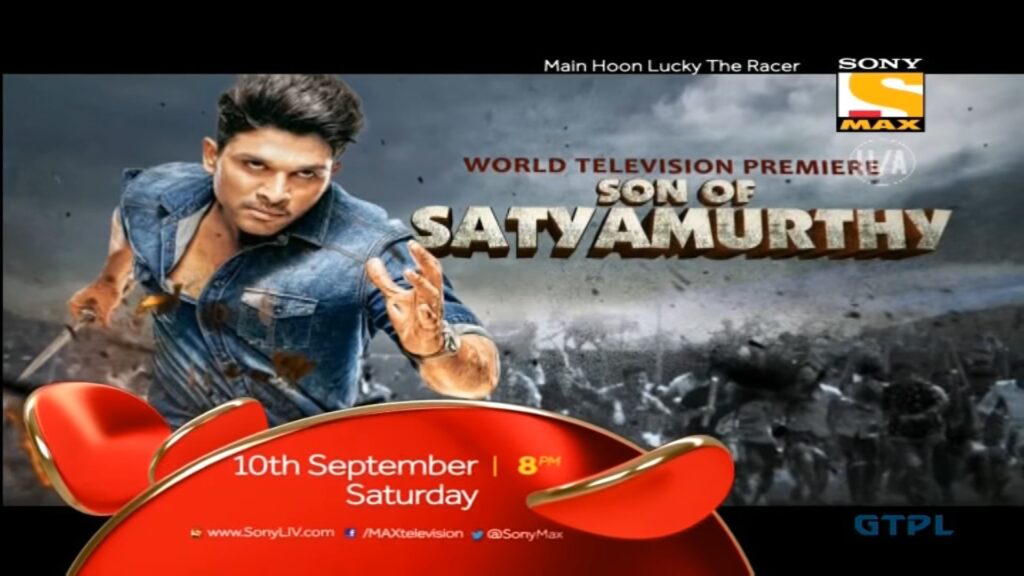

Few Indian movie channels have relied as much on a one-track strategy as Sony Max, only to suffer from it later. For the past several years, it had been witnessing increasing viewership from South Indian (chiefly Telugu and Tamil, often also Kannada) dubbed movies, especially those distributed by Goldmines Telefilms, with which it has had a long-standing partnership. Until early 2021 this single-minded focus on South reaped Sony Max great returns in the BARC ratings chart, as it stayed put at the top and could not be dislodged. Therefore one was most likely to find Son of Satyamurthy, iSmart Shankar or Sarrainodu being aired on the channel, not to mention the blockbuster Baahubali and KGF franchises. As long as it remained on top, it became complacent and completely neglected Bollywood movies, reserving most of them for late-night or early-morning hours (other than mega-blockbusters such as Tiger Zinda Hai, PK, 3 Idiots and Sultan, which are regularly aired across Sony Pictures Networks (SPN)’s Hindi movie channels). Of course, Tiger Zinda Hai and Sultan are produced by Yash Raj Films (YRF), with which SPN had an exclusive deal for the longest time, but it and other studios have been turning away from Sony, as explained later.

However, since the devastating second wave of the pandemic in April and May 2021, combined with BARC ending the release of TRP data on a genre-by-genre basis, Sony Max is being beaten at its own game by Dhinchaak, Goldmines Telefilms’ own free-to-air movie channel, which initially showed dubbed movies in Hindi but later did so in Bhojpuri instead. Dhinchaak has been lighting the ratings chart on fire and, since mid-2021, consistently remains the number one movie channel in Hindi-speaking northern Indian markets, where DD Free Dish has a large penetration. Many of Sony Max’s most prized South movies, such as Sarrainodu and Son of Satyamurthy, have moved over to Dhinchaak and now air there (in Hindi). Sony Wah — SPN’s free-to-air movie channel that is present on DD Free Dish and has a similar schedule as Sony Max (barring the odd Bollywood film) — has taken a severe beating as a result of Dhinchaak’s rapidly increasing popularity.

Unlike its rivals at Star and Zee, Sony Max does not have many companion channels to boast of. Other than Sony Wah, it has just one sister Hindi movie channel: Sony Max 2, which airs only classic movies released until the 2000s. It has remained committed to classic Hindi movies and boasts of several old titles, including the evergreen comedy Andaaz Apna Apna, which it acquired in April. However, of late it has lost a number of titles to other broadcasters, and has been forced to repeat some movies more often than it would have liked. This puts it at a disadvantage compared to rivals like Zee Classic. Nevertheless, out of just 3 Hindi movie channels owned by SPN (before its merger with Zee is completed), Sony Max 2 is the only one to uphold its commitment to evergreen Bollywood films, as the SonyLIV OTT platform, too, has only South dubbed movies.

Strangely enough, Sony Max has continued to acquire new Bollywood movies, only to neglect them shortly after their TV premiere. This list is long, and includes many films originally released on Netflix or Amazon Prime Video: Haseen Dillruba, Sardar ka Grandson, Sherni, Ludo, Gulabo Sitabo, Shakuntala Devi, Time to Dance, Prassthanam and so on. In some cases, such as Tuesdays and Fridays or Mumbai Saga, Sony Max has repeatedly delayed their TV premiere. As an example, Shikara, a period drama produced by Vidhu Vinod Chopra (VVC) Films — Sony’s long-time partner that has given it evergreen hits like Munnabhai M.B.B.S., Lage Raho Munna Bhai, 3 Idiots and PK, besides many other films — was largely ignored after its TV premiere. There was no way a channel so singularly focused on action-packed Telugu masala movies could accommodate such a poignant, artistic drama in its schedule. Ironically, these Bollywood movies are regularly aired on Sony Max’s international feeds, especially the UK version, where usually no South dubbed movies are aired.

Note, however, that none of the above movies are mass blockbuster releases, as they were originally released on Netflix or Amazon Prime Video for discerning, primarily urban audiences. Indeed, after the ill-received Thugs of Hindostan in 2018, Sony has hardly had a big Bollywood blockbuster among its recent releases. Most of the biggest movies in 2019–2021 with top stars have gone to either Star or Zee, and Rowdy Rathore, Sony’s only major Akshay Kumar-starrer in the past decade, has moved over to Star. That said, Akshay Kumar’s latest mass theatre release, Bell Bottom, has had its satellite rights snapped up by Sony, which was increasingly desperate to have a big release as many titles continued to slip away from its hands. In fact, Sony was displaying increasing cooperation with Zee even before their merger was announced, like when the Aparshakti Khurana-starrer Helmet premiered on ZEE5 earlier in September, whereas its satellite rights are with Sony Max.

One thing, though, must be said in Sony’s favour: it has always maintained a high standard of graphics packaging, picture quality and transmission quality for all its channels, and this is especially evident with Sony Max 2, which is steadfastly dedicated to classic movies. SPN is also the only major Indian broadcaster to adopt the 16:9 aspect ratio for many of its SD channels. Going forward with the impending merger with Zee, Sony does stand a good chance of bringing its expertise in handling Hindi movies to good use, now that it will have many more channels to air them on, as explained at the bottom of the article. It would of course have been better if Sony had launched a channel like Star Gold Select or &xplor HD that showed only lesser-known Bollywood movies (as Sony Max HD did in its early days, until late 2017), but the merger with Zee will hopefully solve that problem.

Zee has a wide range of channels but suffers from poor scheduling and repetition

On paper, Zee, with its diverse Hindi movie portfolio, should be on par with Star, given that it does not suffer from having too few channels or too small a library as Sony does. It has a long-term satellite deal with Salman Khan in place, and also signed an expensive distribution deal for Radhe covering both its Zee Plex pay-per-view service and the ZEE5 OTT platform. Zee Cinema has plenty of new Hindi and South releases coming up, including the Hindi TV rights for RRR, S.S. Rajamouli’s magnum opus. It has the rights of a number of Akshay Kumar blockbusters, such as Pad Man, Good Newwz, Kesari, 2.0, Gold and Toilet: Ek Prem Katha. In &pictures, Zee has a channel that delivers a mix of mainstream Bollywood, offbeat Bollywood and Hollywood movies. It has Zee Bollywood, Zee Classic and Zee Action, which offer a plethora of movies as is evident from their names. It has &xplor HD, which is a treasure trove of little-known, critically acclaimed cinema that is eagerly lapped up by cinephiles. And ZEE5 continues to announce new movies in multiple languages every month, including Helmet as mentioned above. What could go wrong?

Plenty, as it turns out. Sure, Zee has been acquiring films steadily, but not all of them have been very popular. On the one hand, the Varun Dhawan-starrer Coolie No. 1 gathered more than 1 crore impressions and thereby became one of the 25 most-watched Bollywood TV premieres ever. On the other, many of Zee’s acquisitions have been lukewarm at best with regard to mass appeal (case in point: Saina, which was originally supposed to premiere on Sony Max but moved to Zee Cinema at the last minute). Radhe was criticised by pretty much anyone who was not a Salman Khan fan. Then you have &pictures, which has lately been directly premiering niche films such as Footfairy, which attract a limited audience, and passing them off as ‘&pictures originals’. There is little point creating artificial hype for a film like Virgin Bhanupriya, which had a disastrous reception on ZEE5 and was heavily promoted by &pictures to little avail.

All the same, both &pictures and Zee Cinema, unlike Sony Max, do give Bollywood films the due recognition they deserve and do not overpopulate their schedule with South Indian or Hollywood dubs. But they do suffer from another problem: repetition. Very often the same film can be found airing on Zee Cinema in the morning, on &pictures in the evening and on the free-to-air Zee Anmol Cinema the following afternoon. Repeating the same set of movies frequently leads to jadedness in viewers. This is something that Disney-Star does much better, as a movie is usually not repeated within a month. Even though Zee has a rich library of old and new Bollywood movies, seeing the same names over and over in the programming guide (EPG) is an injustice to other, rarer movies. This is especially evident on Zee Bollywood, which shows predominantly 1980s/90s movies along with some recent releases (and so is 80% similar to Zee Classic, which shows movies released before 2000). It is as though Zee Bollywood selects films at random from a fixed list of around 50, not going beyond that. Its counterparts, UTV Movies from Disney-Star and Sony Max 2, are better at rotating movies and showing lesser-known classics.

There is one Zee channel that has perhaps the best selection of Hindi movies but suffers from the worst distribution. That is &xplor HD. It has an outstanding collection of movies released in the 21st century that are too niche or arthouse to air on Zee Cinema. Acclaimed titles (Article 15, Gully Boy, Sonchiriya, Raazi, Mulk, Mukkabaaz, Tumbbad, etc.); sleeper-hit comedies like Vicky Donor and Go Goa Gone; cult classics from the 2000s like Lagaan, Dil Chahta Hai and Swades: We The People; well-recognisable hits from more than a decade ago, such as Taare Zameen Par and Ghajini — all of these, and more, find a home on &xplor HD. It is essentially Zee’s answer to Star Gold Select, and has a premium on-air graphics package to match. Sadly, it is too good to be true, and how it has managed to survive two years without any advertisers or proper distribution is something that only Zee knows.

The main problem with &xplor HD is that hardly anyone can see it at all: it is present on just one DTH platform (Airtel Digital TV) and a handful of cable platforms like Fastway and GTPL KCBPL, as well as a live-stream on the ZEE5 app. Other than that, most people simply do not know of the channel, because, for two years now since its launch, it has not been available on Tata Sky, Dish TV or JioTV or most other TV platforms, and there is no sign that it will be added in the future. As a result, there are zero advertisements on the channel, or even promos. It is as if the channel only exists to show films that would not have been aired otherwise, and even some of those titles are sometimes aired on &pictures, which is present on every platform. Nor does &xplor HD have a strong social media presence, and, despite its good intentions, it is barely visible at all. Star Gold Select is at least present on every major TV platform, even if it does not have a large viewership, but for a broadcaster as large as Zee to fail to distribute a premium HD channel on even the most popular platforms, like Tata Sky and JioTV, is simply inexcusable and tragic.

Zee’s Hindi movie cluster has several other problems at hand. It has a dispute with Goldmines Telefilms, which hinders the expansion of its South Indian library, so it has to turn towards other distributors. As it has so many channels, there is considerable overlap between them; for instance, Zee Anmol Cinema and Zee Action are almost clones of each other as they show mostly dubbed South Indian movies. The former is necessary as it has the all-important presence on DD Free Dish, leaving Zee Action redundant. Similarly Zee Classic and Zee Bollywood are near-clones of each other, with a predominantly 1970s-to-1990s schedule; the only difference is that Zee Bollywood is allowed to occasionally show recent movies, while Zee Classic is not. These and other such areas of improvement will come into scrutiny going forward with the merger, and Zee might consider taking a closer look at its Hindi movie channels as it embarks upon becoming ‘a Sony company’.

Viacom18 is growing fast but remains as South-heavy as Sony, except CCB

Viacom18 is owned by Mukesh Ambani’s Reliance Industries, which has always shown a bulldozing attitude in its various businesses, be it the telecom sector through Jio, the TV broadcast business through TV18, or its petrochemical and retail business. Naturally, Reliance’s maverick, move-fast-and-break-things attitude has been prominent in Viacom18’s numerous TV channels, under established brand names such as Colors, MTV, VH1 and Nick. The Hindi movie genre is no exception, though it must be said that Viacom18 was a slow starter: its flagship Hindi movie channel Colors Cineplex (then Rishtey Cineplex) was launched only in 2016 — at least 15 to 20 years after Zee Cinema (1995), Sony Max (1999) and Star Gold (2000). Initially, the then-Rishtey Cineplex showed mostly Bollywood movies, after they were premiered on Colors.

Now, Colors, Viacom18’s flagship Hindi GEC, was well known for premiering movies back in the day, including several Akshay Kumar-starrers (Special 26, Brothers, Gabbar is Back, Airlift, etc.) and a number of titles from Dharma Productions (Hasee Toh Phasee, Humpty Sharma Ki Dulhania, Kapoor and Sons, Shaandaar, etc.). Of late, however, like other Hindi GECs, Colors has mostly given up on new Hindi movie premieres, while Colors Cineplex has taken a different turn and become essentially a copy of Sony Max, showing little apart from South dubbed movies. The same goes for its DD Free Dish sibling Rishtey Cineplex (relaunched under that name in June 2020), which sees no need to show anything but South. That, of course, is par for the course for a Hindi movie channel on DD Free Dish, for which there is no more potent formula for success than action-packed blockbusters starring the likes of Allu Arjun, Mahesh Babu, Jr NTR and Pawan Kalyan.

It might appear on paper that Viacom18 is at as much of a disadvantage as SPN, given that it has only three Hindi movie channels, two of which (Colors Cineplex and Rishtey Cineplex) are as singularly focused on South dubbed movies as Sony Max and Wah. However, the third channel was a surprise launch this April: Colors Cineplex Bollywood (CCB). It differs from Sony Max 2 in that it shows a broad mix of both recent and old titles, making it more comparable to a Star Gold 2 or a Zee Bollywood — except with better scheduling and a much broader range with little to no repetition. Some other films that are aired on CCB include Welcome, Mary Kom, Tanu Weds Manu, Om Shanti Om, the evergreen comedies Hera Pheri and Phir Hera Pheri, the National Award-winning Andhadhun, and more recently the blockbuster Chennai Express which has moved over from Zee.

Unfortunately, CCB suffers from the same problem as &xplor HD: lack of good distribution. It is available on Airtel Digital TV and Dish TV, but not Tata Sky, Sun Direct or several cable platforms. Curiously enough for a channel that doesn’t show South masala movies, it is also present on DD Free Dish, giving rural viewers a Bollywood alternative. But Viacom18 clearly has larger distribution issues at hand, as Rishtey Cineplex is not available on Tata Sky either. These need to be ironed out, and very soon. Until the distribution of CCB and Rishtey Cineplex is improved, Viacom18 will continued to be perceived by many viewers as a fringe broadcaster as far as the Hindi movie sector is concerned, and not someone who has the muscle to compete with Zee Cinema or Star Gold.

But if you ignore Viacom18, do so at your own peril. It may not be showing as many Bollywood movies as one would have liked on its two main channels, but that does not mean that it is ignoring the acquisition of new ones — unlike Sony Max, which genuinely appears to be clueless regarding its Bollywood strategy. It is just that Viacom18 chooses to show all its Hindi movies on CCB, ensuring that they are not neglected, something Sony Max has thus far failed at. For example, of the six films directed by Karan Johar, four of them (Kuch Kuch Hota Hai, Kabhi Khushi Kabhie Gham…, Kabhi Alvida Naa Kehna and Ae Dil Hai Mushkil) are shown on CCB, while Student of the Year, having expired from Sony Max a couple of years ago, is most likely to be renewed by Viacom18 — as its sequel is already. (The sixth Karan Johar-directed film, My Name is Khan, has so far refused to move from Star Gold Select, unlike KKHH, K3G and KANK, which Viacom18 acquired from Star.)

At the same time, Viacom18 has strengthened its long-standing partnership with Johar’s studio Dharma Productions, which has given it a number of hit rom-coms in the past as mentioned above. The broadcaster recently grabbed the rights of Dharma’s war drama Shershaah, and this month its production house Viacom18 Studios also signed a deal with Dharma to co-produce four upcoming films, including the multi-starrer Jug Jugg Jeeyo; the satellite rights will automatically go to Colors. Additionally it has several other deals in place, like one with Sanjay Leela Bhansali, which has given it period dramas such as Bajirao Mastani, Padmaavat and the older Goliyon Ki Raasleela Ram-Leela, which recently moved to Viacom18 from Sony.

All this is to say that thanks to its various partnerships with movie studios — with the Dharma one being as exceptionally strong as that between Sony and YRF in its heyday — and its own in-house productions, Viacom18 is well poised to single-handedly take on Disney-Star and the Zee-Sony colossus, as it already does in the Hindi GEC sector, and will do so soon in sports. But its subpar handling of movie scheduling on Colors Cineplex and its poor distribution of CCB currently limit its potential to be a much bigger force than it is now.

Star’s YRF deal and Dhinchaak have dealt Sony a double whammy

As if Sony Max was not struggling enough, Disney-Star dealt it a body blow in July, when it grabbed the satellite rights of a number of Yash Raj Films (YRF) movies. The iconic production house has had an exclusive satellite deal with Sony since the latter commenced Indian operations in 1995. Classics like Deewar, Lamhe and Chandni made up an important part of Sony Max 2’s schedule. Offbeat movies such as Band Baaja Baaraat, Shuddh Desi Romance, Rab Ne Bana Di Jodi, Dum Laga Ke Haisha and Jab Tak Hai Jaan were sometimes shown on Sony Max HD (and, before 2016, on Sony Entertainment Television as well). And mega-blockbusters such as Dhoom: 3, Sultan, Ek Tha Tiger and Tiger Zinda Hai were given high prominence on Sony Max and Sony Wah, airing every few weeks. In one fell swoop, the equation changed. Now, Disney-Star had already signed a new deal with YRF in 2019, thereby getting the satellite rights of all its movies from War and Mardaani 2 onwards, but the fact that YRF would give up a decades-long partnership with SPN, even partially, was hard for many to digest.

To be sure, the rights of more than half of all YRF productions remain with SPN, including Chak De! India, Sultan, Ek Tha Tiger and Tiger Zinda Hai, as well as niche films like Hichki, Ishaqzaade and Sui Dhaaga, which are at least played on Sony Max’s international feeds if not the Indian channels. Many of them which were released before 2015 had their world TV premiere on Sony TV and were also aired frequently on Sony Max (which didn’t have an HD feed at the time), before its transition to South from that year. (When Sony Max HD was launched on Christmas 2015, Sony TV completely stopped showing movies altogether.) But Disney-Star started premiering many YRF movies across its channels in July 2021, ranging from modern-day blockbusters like Dhoom, Dhoom: 3 and Gunday, to romances such as Dilwale Dulhania Le Jayenge, Hum Tum, Mohabbatein and Dil Toh Pagal Hai, to classics like Silsila, Darr and Chandni. The newer or more famous films like DDLJ were premiered on Star Gold (2), and the older ones on UTV Movies or Star Utsav Movies.

Aside from Disney-Star snatching the rights of so many YRF movies, leaving its already feeble Hindi library considerably weaker, SPN has also been badly affected in its core strength area, South dubbed movies, by the advent of Dhinchaak. The Goldmines-owned movie channel, as described above, has been a backstabber of sorts for Sony Max, which has been heavily dependent on Goldmines for its South movie library. Dhinchaak has been bad news not just for Sony Max and Sony Wah, but also other free-to-air Hindi movie channels from small broadcasters like B4U Movies, B4U Kadak, Enterr10 Movies and Cinema TV India, which have been forced to relook at their movie syndication and acquisition strategy to stay afloat.

Which is why Sony’s Hindi movie cluster needed the merger with Zee more desperately than ever.

The upcoming Zee-Sony merger could disrupt everything

Interestingly, SPN was originally in talks to merge with Viacom18 in 2020, but Mukesh Ambani finally called off the deal in October that year. This left SPN’s already struggling Hindi movie cluster in greater trouble, as it could not find a way to break the rut. The exodus of both Hindi and South movies continued to hurt the reputation of Sony Max, even if it did not reflect on the ratings chart immediately. But the surprise announcement of SPN’s merger with Zee Entertainment Enterprises earlier this week brings with it large-scale ramifications, and is ultimately a win-win for everyone involved. Zee was struggling to stay afloat in the Hindi GEC and Marathi genres, though its other regional businesses were going well; and Sony’s high-flying Hindi GEC and sports businesses were offset by its floundering Hindi movie cluster. Now, the combined entity has the power to take complete control of the Indian TV industry, overpowering the perennial leader Disney-Star. With over 75 TV channels in India alone, a global content and distribution business and two small but rapidly growing OTT platforms (ZEE5 and SonyLIV), it is a genuine contender to put a stop to the dominance of Star and its Disney+ Hotstar platform.

The Hindi movie genre is no exception. So far Disney-Star has enjoyed great success with the right strategy of acquisition, scheduling and rotation of Bollywood movies, combined with the excellent distribution of channels, pricing and packaging. Its only weak spots are the Hollywood-focused channels UTV Action and UTV HD. In contrast, Zee has a wide range of channels and a large library, but it is not so adept at scheduling movies across different channels, or distributing its premium channel &xplor HD. Sony is even worse off, as it has been neglecting Bollywood movies (except the classic channel Sony Max 2) and relying heavily on South dubbed movies, only to be betrayed by Goldmines and Dhinchaak. But the combined entity has the might of both a wide range of Hindi movie channels and a massive content library across Bollywood, Hollywood and South. If only it can improve on the scheduling and distribution front, there will be nothing stopping it going forward, as it will have a whopping 63% market share in the genre.

Despite Sony Max’s weaknesses, it still does have a handful of content and distribution deals in place. For one, in spite of the mass exodus to Disney-Star in July, SPN still does have the majority of YRF movies in its stable. Also, it has had a long-running deal with T-Series Films, which has given it a long list of sleeper hits: Pati Patni Aur Woh, Kabir Singh, Sonu Ke Titu Ki Sweety, Hindi Medium, Tumhari Sulu, Durgamati, etc. Zee, too, has no shortage of blockbusters starring Salman Khan and Akshay Kumar, as well as smaller-budget films perfectly suited for &pictures or &xplor HD. Though this is speculation, there is also the off-chance that Netflix exclusives like The Sky is Pink, Serious Men, AK vs AK, Tribhanga and Pagglait might get a TV premiere on &xplor HD if Zee-Sony shows some proactiveness in acquiring their satellite rights first. These are a perfect fit for the selective, curated nature of the channel and could hence reach a wider audience if its distribution is increased.

If the combined Zee-Sony supergiant is able to iron out these issues and turn its weaknesses in the Hindi movie genre into strengths, Disney-Star’s long run at the top of the genre may soon have its days numbered, and it will be even more difficult for Viacom18, Dhinchaak or free-to-air broadcasters to compete with them. Consolidation may be detrimental for those smaller players, but this merger gives Zee and Sony a better chance than ever before to end the unconquered dominance of Disney-Star and become India’s leading Hindi movie broadcaster, with a huge portfolio of channels, titles and digital productions.

Disclaimer: Views expressed are the author’s own.

Nice article, Sohum. Since the acquisition of it’s channels by Disney. Star has become the best movie channel in the country. One thing Star is failing to do is captilize on the rights they got. Streaming plans are sold on annual basis.

They got thousands of hours of content from sports to infotainment to movies and entertainment. Movie channels are bought on monthly and daily basis. Their sole purpose is to destination of movies. Star has huge advantage here. They are known to acquire both streaming and broadcast rights at same time. They can air movies like Bhuj, The Big Bull etc. on television first which can keep the tv fresh and relevant. And premiere the movie following day on OTT service. They can set a good example.

Excellent opinion as always, DJ. The problem is that most of the movies premiered on Disney+ Hotstar (The Big Bull, Hungama 2, Sadak 2, etc.) have a poor reputation with critics and are often simply unwatchable. However, Laxmii and Roohi might have been trashed by critics but the audiences loved them. Thankfully, Star network’s other movies are much better than those that are premiered on Disney+ Hotstar, especially those that come from YRF or Jio/Maddock.

Fresh content is always appreciated by audience. Even an average movie like Bhuj would’ve been appreciated by audience on a day like on Independence Day. Last movie I recall watching premiere first on TV was Why Cheat India? As it aired on Star Gold one day prior to it’s OTT release on Zee5. Even last movie that created true buzz around tv premiere on my social circle was Stree which also had tv premiere first.